economics

Human-robot interaction in workplaces is a research area which remains unexplored.

In this paper, we present the results and analysis of a social experiment we conducted by introducing a humanoid robot (Nadine) into a collaborative social workplace.

The humanoid’s primary task was to function as a receptionist and provide general assistance to the customers. Moreover, the employees who interacted with Nadine were given over a month to get used to her capabilities, after which, the feedback was collected from the staff on the grounds of influence on productivity, affect experienced during interaction and their views on social robots assisting with regular tasks.

Our results show that the usage of social robots for assisting with normal day-to-day tasks is taken quite positively by the co-workers and that in the near future, more capable humanoid social robots can be used in workplaces for assisting with menial tasks.

{ PsyArXiv | Continue reading }

related { Is an Army of Robots Marching on Chinese Jobs? }

art { Hajime Sorayama }

economics, relationships, robots & ai | May 27th, 2019 12:53 pm

Romantic mouth-to-mouth kissing is culturally widespread, although not a human universal, and may play a functional role in assessing partner health and maintaining long-term pair bonds. Use and appreciation of kissing may therefore vary according to whether the environment places a premium on good health and partner investment.

Here, we test for cultural variation (13 countries from six continents) in these behaviours/attitudes according to national health and both absolute (GDP) and relative wealth (GINI).

Our data reveal that kissing is valued more in established relationships than it is valued during courtship.

Also, consistent with the pair bonding hypothesis of the function of romantic kissing, relative poverty (income inequality) predicts frequency of kissing across romantic relationships.

{ Nature | PDF }

photo { Garry Winogrand, New York, 1966 }

economics, relationships | May 27th, 2019 8:04 am

If you wear designer glasses, there’s a very good chance you’re wearing Luxottica frames.

The company’s owned and licensed brands include Armani, Brooks Brothers, Burberry, Chanel, Coach, DKNY, Dolce & Gabbana, Michael Kors, Oakley, Oliver Peoples, Persol, Polo Ralph Lauren, Ray-Ban, Tiffany, Valentino, Vogue and Versace.

Along with LensCrafters, Luxottica also runs Pearle Vision, Sears Optical, Sunglass Hut and Target Optical, as well as the insurer EyeMed Vision Care.

And Italy’s Luxottica now casts an even longer shadow over the eyewear industry after merging last fall with France’s Essilor, the world’s leading maker of prescription eyeglass lenses and contact lenses. The combined entity is called EssilorLuxottica. […]

“You can get amazingly good frames, with a Warby Parker level of quality, for $4 to $8,” Butler said. “For $15, you can get designer-quality frames, like what you’d get from Prada.”

And lenses? “You can buy absolutely first-quality lenses for $1.25 apiece,” Butler said.

Yet those same frames and lenses might sell in the United States for $800.

{ Los Angeles Times | Continue reading }

photo { Jeff Wall, Parent child, 2018 }

economics, eyes, photogs | May 27th, 2019 7:42 am

Multidisciplinary studio curiosity has completed the flagship store of streetwear brand hipanda in omotesando, tokyo, combining digital and analogue features. The immersive retail interior brings together architectural elements with AR (augmented reality) and AE (augmented experience) technology in a sequence of spaces, inviting the visitor to look for the ‘host’ of the house, who is revealed through different interactive experiences, some digital and other analogue.

Curiosity has decked the hipanda store façade with the brand’s logo, which ‘jumps’ towards passersby with visual effects displayed through animations. inside, the main room features a play of light in constant motion, while the gallery space introduces products in a constant movement through AR, continually changing the presentation of the displays to bringing attention to the collection. The room’s walls are half-clad in mirrors, blurring the perception between digital and virtual.

{ designboom | Continue reading }

photo { Butcher shop specialized in game meat and poultry exhibiting a camel, Paris, 1908 }

economics, technology, visual design | May 27th, 2019 7:40 am

After one too many snowstorms, Boston tech executive Larry Kim had had it with shoveling out his car and struggling to find parking. So in 2014 he ditched his Infiniti luxury sedan and began commuting by Uber and Lyft—at an annual cost of as much as $20,000. I would never go back to owning a car,” says Kim […]

Auto sales in the U.S., after four record or near-record years, are declining this year, and analysts say they may never again reach those heights. […] IHS sees the biggest impact of mobility services coming in China. Auto sales there plunged 18 percent in January, an unprecedented seventh consecutive monthly decline, as commuters rapidly embraced ride-hailing. Last year, 550 million Chinese took 10 billion rides with the Didi ride-hailing service. That’s twice as many rides as Uber provided globally in 2018. “Increasing numbers of Chinese are opting for mobility as a service over car ownership,” wrote Michael Dunne, CEO of automotive researcher ZoZo Go. […]

Replacing a taxi driver with a robot cuts 60 percent from a ride’s cost, making travel in a driverless cab much cheaper than driving your own car.

{ Bloomberg | Continue reading }

economics, motorpsycho, robots & ai, transportation | May 27th, 2019 6:40 am

The Evian bottle you tossed in the recycling bin may appear on a shelf at the grocery store a year from now. […]

for much of the last century, clothes were considered durable goods, rather than disposable goods, so the problem of recycling clothes seemed less pressing than recycling, say, plastic bottles. But fast fashion made clothes so cheap that many consumers now think of clothes as disposable. […] A new era of fashion recycling is finally arriving. A startup called For Days, for instance, has created a T-shirt subscription service that allows customers to return a shirt after they are done wearing it, and the company will recycle that material into new T-shirts.

{ Fast Company | Continue reading }

economics, fashion | May 1st, 2019 3:15 pm

The Peter Principle states that organisations promote people who are good at their jobs until they reach their ‘level of incompetence’, implying that all managers are incompetent. This column examines data on worker- and manager-level performance for almost 40,000 sales workers across 131 firms and finds evidence that firms systematically promote the best salespeople, even though these workers end up becoming worse managers, and even though there are other observable dimensions of sales worker performance that better predict managerial quality. […]

We provide evidence that the Peter Principle may be the unfortunate consequence of firms doing their best to motivate their workforce. As has been pointed out by Baker et al. (1988) and by Milgrom and Roberts (1992), promotions often serve dual roles within an organisation: they are used to assign the best person to the managerial role, but also to motivate workers to excel in their current roles. If firms promoted workers on the basis of managerial potential rather than current performance, employees may have fewer incentives to work as hard.

We also find evidence that firms appear aware of the trade-off between incentives and matching and have adopted methods of reducing their costs. First, organisations can reward high performers through incentive pay, avoiding the need to use promotions to different roles as an incentive. […] Second, we find that organisations place less weight on sales performance when promoting sales workers to managerial positions that entail leading larger teams. That is, when managers have more responsibility, firms appear less willing to compromise on their quality.

Our research suggests that companies are largely aware of the Peter Principle.

{ VoxEU | Continue reading }

economics | May 1st, 2019 2:16 pm

“What happens if you can actually automate all human intellectual labor?” said Greg Brockman, chairman of OpenAI, a company backed by several Silicon Valley billionaires. Such thinking computers might be able to diagnose diseases better than doctors by drawing on superhuman amounts of clinical research, said Brockman, 30. They could displace a large number of office jobs. Eventually, he said, the job shortages would force the government to pay people to pursue their passions or simply live. Only Andrew Yang, a long-shot presidential candidate and tech entrepreneur, supported the idea of government paying citizens a regular income. But the idea of a “universal basic income” was discussed regularly in the valley. […]

“Once we have meat substitutes as good as the real thing, my expectation is that we’re going to look back at eating meat as this terrible, immoral thing,” he said. The same could be true of work in a future in an era of advanced artificial intelligence. “We’ll look back and say, ‘Wow, that was so crazy and almost immoral that people were forced to go and labor in order to be able to survive,’ ” he said.

{ Washington Post | Continue reading }

economics, technology | April 24th, 2019 11:01 am

Software from Amenity Analytics promises to automate this process by spotting when chief executive officers try to duck tough questions. The software, its makers say, can even pick up on the signs of potential deception that CIA and FBI interrogators look for—including stalling and the use of qualifiers—and can gauge the sentiment of what is said on calls and reported in public filings, issuing a positive or negative numeric score. The goal is to make it easier for investors to wade through information and quickly make trading decisions.

{ Bloomberg Businessweek | Continue reading }

previously { Former CIA Officer Will Teach You How to Spot a Lie }

photo { Laurie Simmons, Blonde/Pink Dress/Standing Corner, 2014 }

psychology, technology, traders | April 22nd, 2019 6:58 am

Alien abduction insurance pays insured individuals under the event that they are abducted by aliens. […] To date, tens of thousands of people have purchased alien abduction insurance, and the famed Lloyd’s of London claims to have sold more than 40,000 of them. To receive compensation from Lloyd’s, policyholders must pass a lie-detector test, and provide video footage or a third-party witness.

[…]

12 years ago, 3 sisters from the city of Inverness, Scotland, took out coverage from Essex-based Britishinsurance.com to insure themselves against the costs of immaculately conceiving and raising the second Christ.

These women, however highly they think of themselves, paid annual premiums of EUR 100 to the company, and were insured to receive EUR 1 million if the event did occur.

{ Pacific Prime | Continue reading }

related { Five Traits That Could Get You “Abducted by Aliens” }

still { The Raven, 1970 | kid home movie }

economics | April 14th, 2019 11:48 am

An April 2016 Council of Economic Advisers (CEA) report advocated raising the minimum wage to deter crime. […]

Our results provide no evidence that minimum wage increases reduce crime. Instead, we find that raising the minimum wage increases property crime arrests among those ages 16-to-24, with an estimated elasticity of 0.2. This result is strongest in counties with over 100,000 residents and persists when we use longitudinal data to isolate workers for whom minimum wages bind.

Our estimates suggest that a $15 Federal minimum wage could generate criminal externality costs of nearly $2.4 billion.

{ National Bureau of Economic Research | Continue reading }

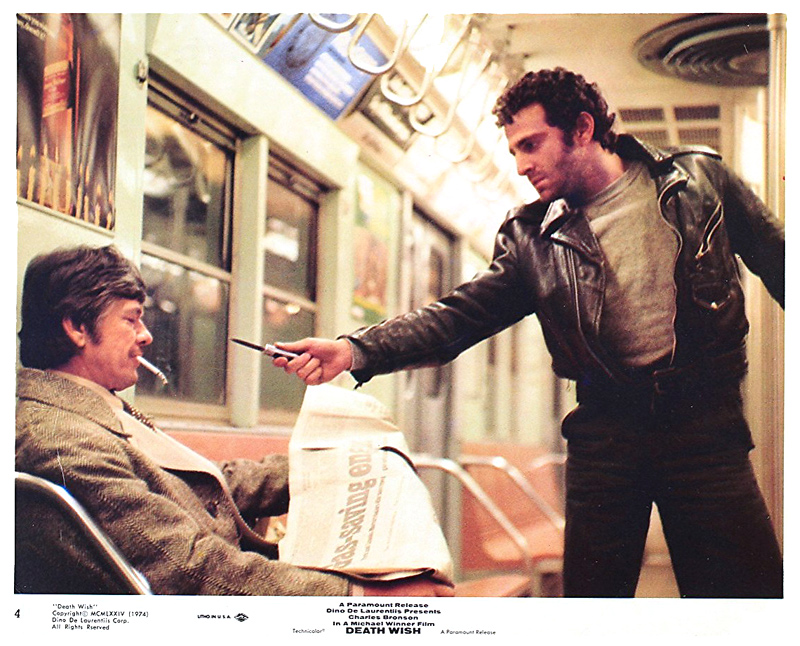

still { Death Wish, 1974 }

crime, economics | April 10th, 2019 10:18 am

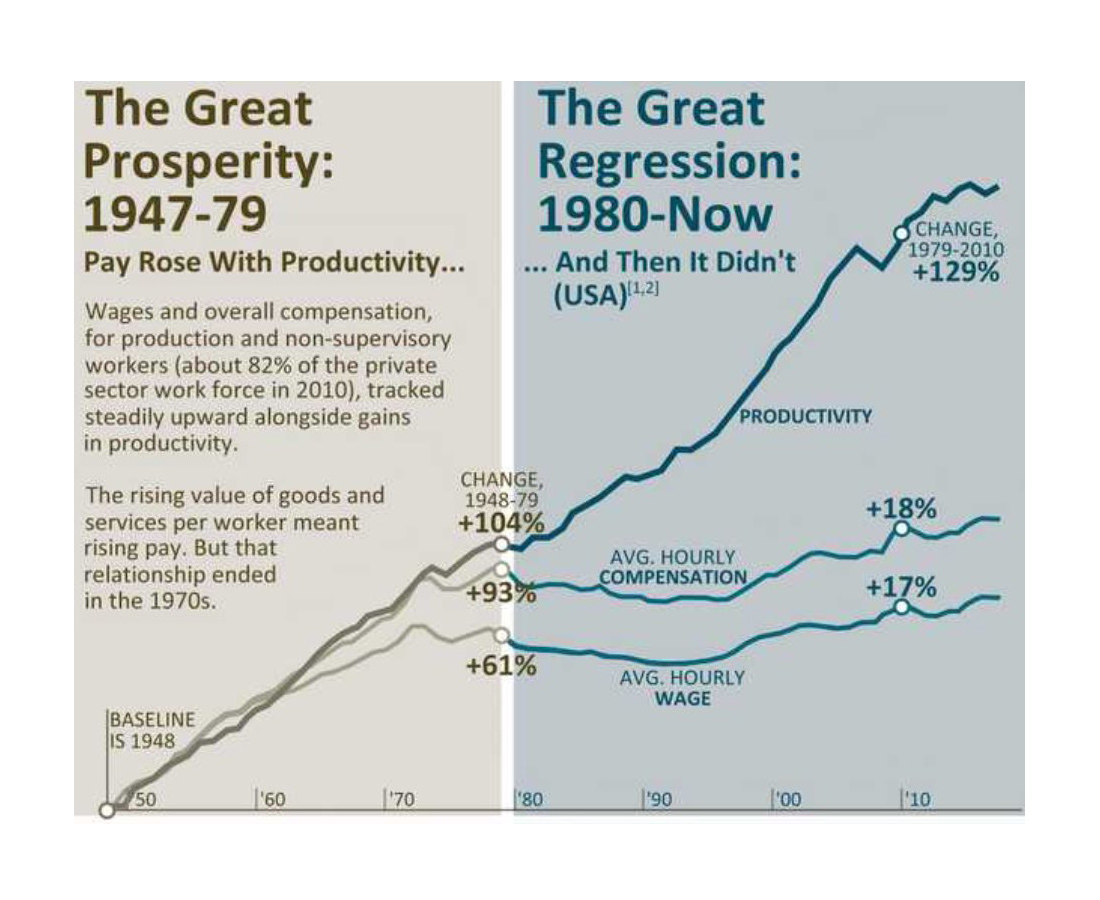

economics | April 2nd, 2019 11:52 am

Ten years after the financial dramas of Autumn 2008, I take stock of what we have learned, what we have done, and what we have yet to do if we would avoid a repeat performance.

The primary lessons I draw are that income and wealth distribution, the endogeneity of credit-money, and finance system structure all matter profoundly not only where justice, but also where systemic stability is concerned.

The longer-term tasks still before us include a much broader and financially engineered diffusion of capital ownership over our population, citizen central banking, a permanent national investment authority, continuous public open labor market operations, debt-free or low-debt education and health insurance, and an updated form of segregating capital-raising primary from asset-trading secondary markets in the financial sector.

Shorter-term tasks include debt-forgiveness, a restoration of labor rights and countercyclical progressive taxation, and restored citizen-ownership of our secondary market makers in home mortgage and higher education debt.

{ LawArXiv | Continue reading }

U.S., economics, theory | March 12th, 2019 7:27 am

I have itemized data for a single line in New York (Second Avenue Subway Phase 1) and a single line in Paris (Metro Line 1 extension), from which I have the following costs:

Tunneling: about $150 million per km vs. $90 million, a factor of 1.7

Stations: about $750 million per station vs. $110 million, a factor of 6.5

Systems: about $110 million per km vs. $35 million, a factor of 3.2

Overheads and design: 27% of total cost vs. 15%, which works out to a factor of about 11 per km or a factor of 7 per station

[…]

In Paris, as well as Athens, Madrid, Mexico City, Caracas, Santiago, Copenhagen, Budapest, and I imagine other cities for which I can’t find this information, metro stations are built cut-and-cover. While the tunnels between stations are bored, at higher cost than opening up the entire street, the stations themselves are dug top-down. This allows transporting construction materials from the top of the dig, right where they are needed, as well as easier access by the workers and removal of dirt and rock. There is extensive street disruption, for about 18 months in the case of Paris, but the merchants and residents get a subway station at the end of the works.

In contrast, in New York, to prevent street disruption, Second Avenue Subway did not use any cut-and-cover. The tunnels between stations were bored, as in nearly all other cities in the world that build subways, and the stations were mined from within the bore, with just small vertical shafts for access. The result was a disaster: the costs exploded, as can be seen in the above comparison, and instead of 18 months of station box-size disruption, there were 5 years of city block-size disruption, narrowing sidewalks to just 2 meters (7′ to be exact).

{ Pedestrian Observations | Continue reading }

pencil, ink, and enamel on tracing paper { Elena Asins, Scale, 1982-1983 }

economics, new york, paris, underground | March 10th, 2019 3:31 pm

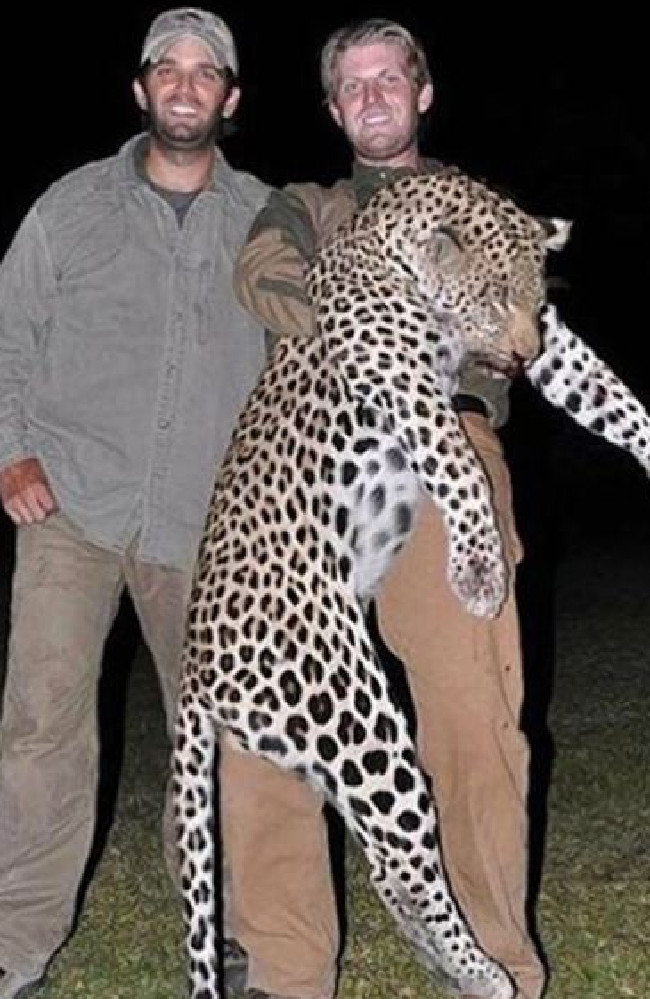

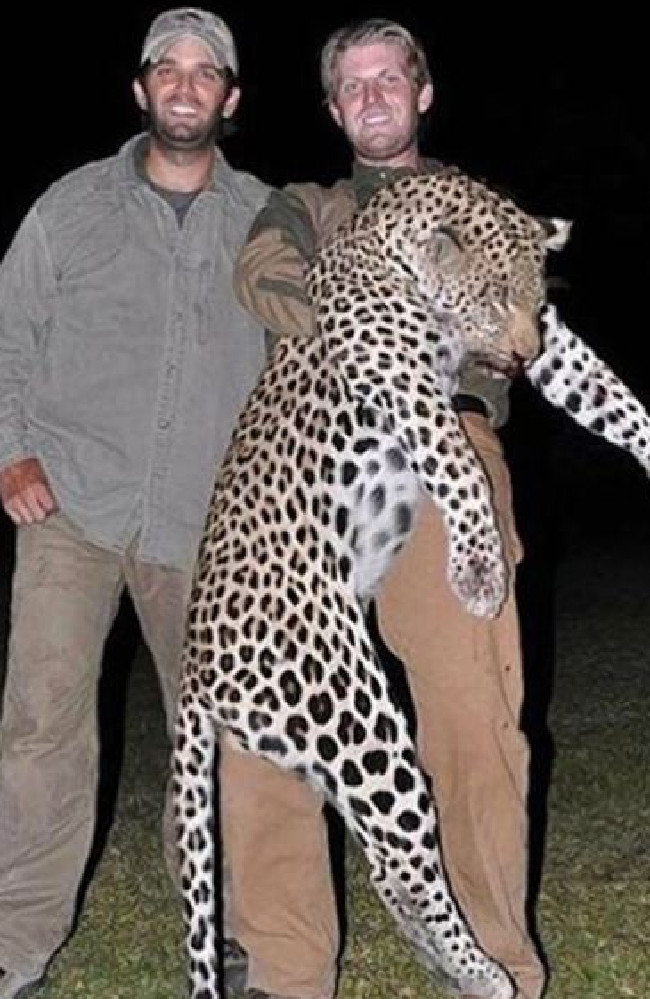

A company tied to Donald Trump Jr. and Eric Trump owns a 171-acre hunting preserve that is being used as a private shooting range. […]

During negotiations, said Joe Kleinman — who with his wife, Jocelyn, sold the property in August 2013 for $665,000 — the buyer’s agent tried to reduce the price by invoking a 1991 state court decision that requires buyers disclose to sellers if a property is known to be haunted.

Kleinman refused, saying anyone who truly believed it was haunted would either abandon the sale or pay a premium.

{ Poughkeepsie Journal | Continue reading }

quote { entire crew is HorseFaced for real }

U.S., guns, housing | March 7th, 2019 1:55 pm

[I]t is getting harder to target gamers via traditional advertising techniques, because an increasing number of consumers spend more of their digital days behind paywalls, where there is often no advertising. These are also typically the most engaged and most-spending audiences.

To win some of the attention back, games companies must target gamers behind paywalls, be it through product placement or original content on video streaming services or podcasts and playlists on music services.

{ MIDIA | Continue reading }

economics, leisure, marketing | February 18th, 2019 9:00 am

Bitcoin Is Worth Less Than the Cost to Mine It

The production-weighted cash cost to create one Bitcoin averaged around $4,060 globally. […] With Bitcoin itself currently trading below $3,600, that doesn’t look like such a good deal. However, there’s a big spread around the average. […] Low-cost Chinese miners are able to pay much less — the estimate is around $2,400 per Bitcoin — by leveraging direct power purchasing agreements with electricity generators such as aluminum smelters looking to sell excess power generation.

{ Bloomberg | Continue reading }

art { Marcel Duchamp, 3 stoppages-étalon, 1913-14 | MoMA, NYC | Centre Pompidou, Paris }

cryptocurrency | February 4th, 2019 9:00 am

The problems of darknet markets have triggered an evolution in online black markets. […]

Instead of using websites on the darknet, merchants are now operating invite-only channels on widely available mobile messaging systems like Telegram. This allows the merchant to control the reach of their communication better and be less vulnerable to system take-downs. To further stabilize the connection between merchant and customer, repeat customers are given unique messaging contacts that are independent of shared channels and thus even less likely to be found and taken down. Channels are often operated by automated bots that allow customers to inquire about offers and initiate the purchase, often even allowing a fully bot-driven experience without human intervention on the merchant’s side. […]

The other major change is the use of “dead drops” instead of the postal system which has proven vulnerable to tracking and interception. Now, goods are hidden in publicly accessible places like parks and the location is given to the customer on purchase. The customer then goes to the location and picks up the goods. This means that delivery becomes asynchronous for the merchant, he can hide a lot of product in different locations for future, not yet known, purchases. For the client the time to delivery is significantly shorter than waiting for a letter or parcel shipped by traditional means - he has the product in his hands in a matter of hours instead of days. Furthermore this method does not require for the customer to give any personally identifiable information to the merchant, which in turn doesn’t have to safeguard it anymore. Less data means less risk for everyone.

{ Opaque | Continue reading }

photo { Weegee }

crime, economics, technology | January 24th, 2019 5:18 pm

identical twins […] bought home kits from AncestryDNA, MyHeritage, 23andMe, FamilyTreeDNA and Living DNA, and mailed samples of their DNA to each company for analysis. Despite having virtually identical DNA, the twins did not receive matching results from any of the companies. […]

An entire DNA sample is made up of about three billion parts, but companies that provide ancestry tests look at about 700,000 of those to spot genetic differences.

{ CBC | Continue reading }

economics, genes | January 20th, 2019 10:17 am

{ The Holotypic Occlupanid Research Group occupies itself by doing “research in the classification of occlupanids. These small objects are everywhere, dotting supermarket aisles and sidewalks with an impressive array of form and color.” | Improbable Research }

economics, visual design | January 15th, 2019 12:18 pm