‘well, might it not be said that every photograph of a living person will eventually become a picture of the Dead?’ –Peter Manseau

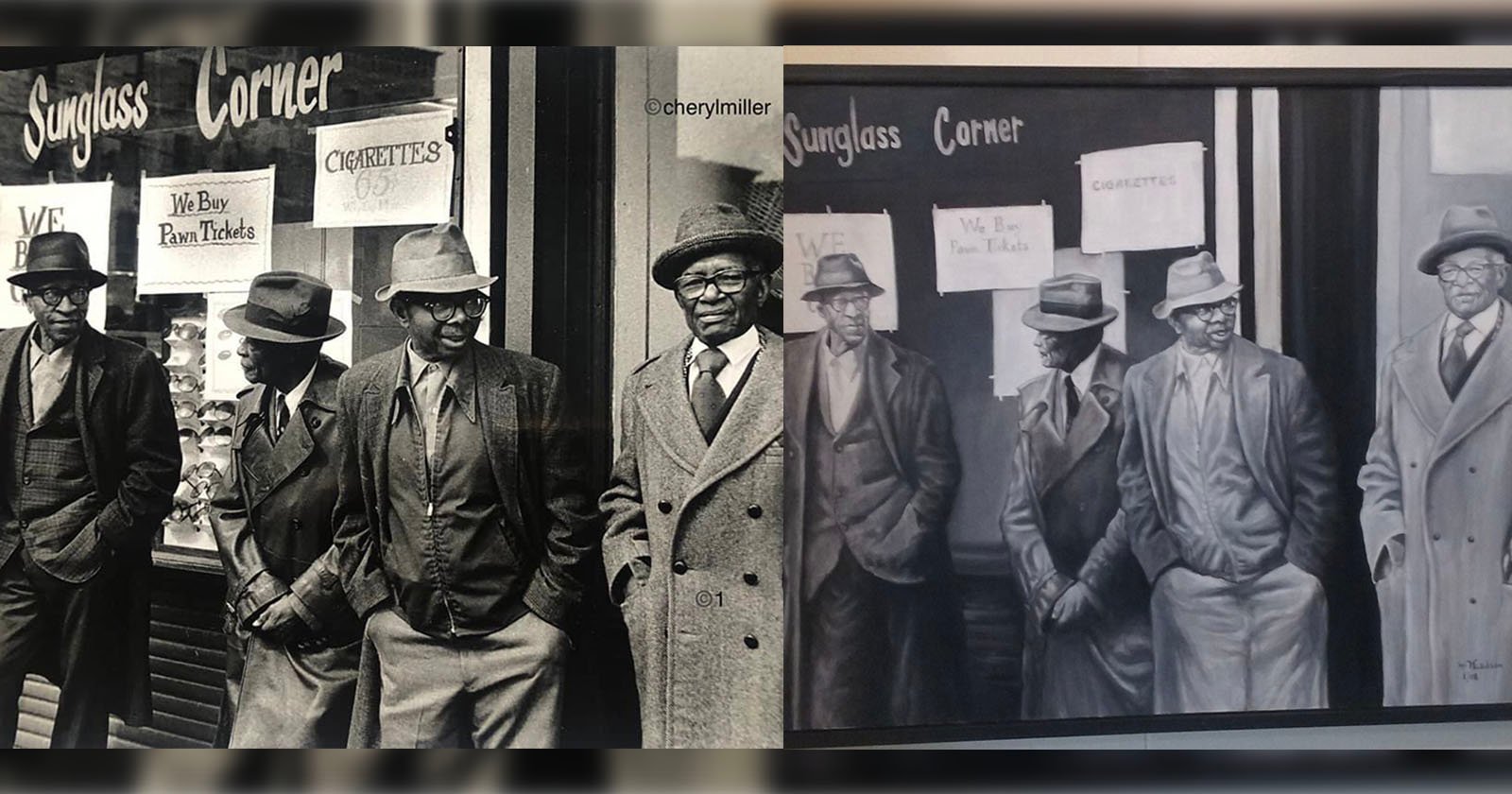

William H. Mumler (1832–1884) was an American spirit photographer who worked in New York City and Boston. His first spirit photograph was apparently an accident—a self-portrait which, when developed, also revealed the “spirit” of his deceased cousin. Mumler then left his job as an engraver to pursue spirit photography full-time, taking advantage of the large number of people who had lost relatives in the American Civil War. […]

Mumler’s wife, Hannah Mumler, was also a famous healing medium, and conducted her own spiritual business in addition to the business of assisting her husband.

{ Wikipedia | Continue reading }

When spirit photography appeared in the 1860s, the United States was reeling from the Civil War, which claimed an astonishing 620,000 lives. Deep in mourning, Americans were drawn to anyone who offered even a fleeting connection to the souls of their dearly departed. Self-proclaimed mediums performed seances in which the living could speak with the dead, and photographers like Mumler granted the wishes of the bereaved to see their lost sons or brothers one last time. […]

While taking self-portraits for practice, one of Mumler’s prints came back with an unexplainable aberration. Although he was “quite alone in the room” when the shot was taken, there appeared to be a figure at his side, a girl who was “made of light.” Mumler showed the photo to a spiritualist friend who confirmed that the girl in the image was almost certainly a ghost. […]

Mumler had a knack for self-promotion and his otherworldly photo was written up in popular spiritualist newspapers like the Banner of Light and also the mainstream press. Bostoners began lining up at his small portrait studio to pay as much as $10 for their likeness with a lost loved one.

One of his most famous images is the photograph of Mary Todd Lincoln with the ghost of her husband Abraham Lincoln.

Over time, the evidence against Mumler started to mount. […] A man visiting Mumler’s studio recognized a female ghost as his wife, who was not only alive but recently had her portrait taken by Mumler. Wasn’t it obvious that Mumler was reusing old negatives and playing them off as ghosts?

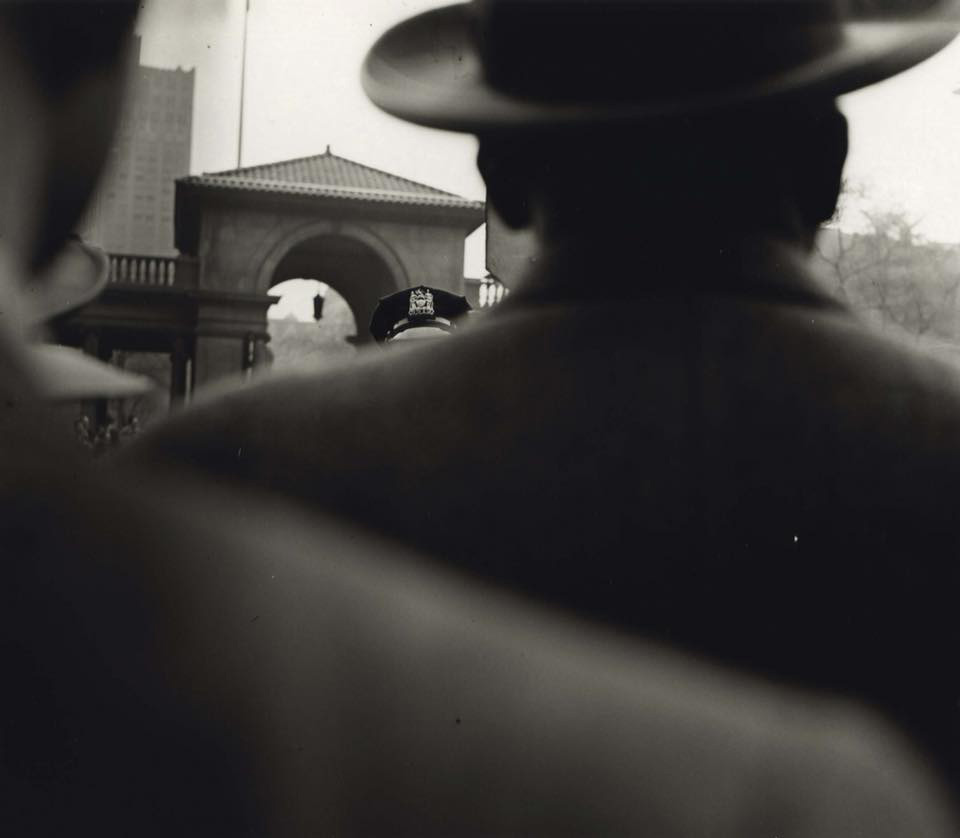

Since things were getting hot in Boston, Mumler tried relocating to New York in 1869, but he was quickly arrested and tried for fraud. The New York prosecutors called a parade of expert witnesses who offered at least nine ways that Mumler could have used photographic trickery to produce his ghostly images. […]

Despite the best efforts of so many investigators, no one was able to solve the riddle of exactly how Mumler created his apparitions.

Mumler was acquitted and returned to Boston. He shied away from spirit photography and refocused his efforts on the chemistry of photo development. He eventually invented a technique called the “Mumler process” that allowed the first photographs to be printed on newsprint, transforming the practice of journalism.

trailer { Smile for the Dead (2025), a documentary film about William H. Mumler }