‘Self-parody precedes selfhood.’ —Rob Horning

Twitter co-creator whose real name is actually Biz Stone has a new project called “Jelly.” No one knows what it is, other than an epicenter of vagaries and tech intrigue. […] In a blog post on its mystery Tumblr, Jelly announced its latest financials backers:

Jack Dorsey, Co-founder and CEO of Square

Bono, Musician and Activist

Al Gore, Politician, Philanthropist, Nobel Laureate

Greg Yaitanes, Emmy Winning Director

Roya Mahboob, Afghan Entrepreneur and Businesswoman[…]

By Jelly’s own admissions, the “product” is still in “early prototyping,” so these celeb investors aren’t even completely sure what they’re investing in. Whatever it is, it will have something to do with “mobile devices [taking] an increasingly central role in our lives,” since “humanity has grown more connected than ever,” and “herein lies massive opportunity.”

{ ValleyVag | Continue reading }

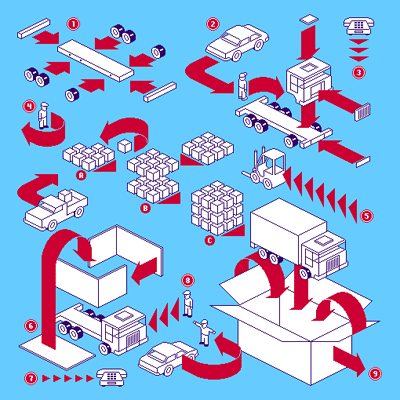

“Jelly” has been a closely guarded secret. […] Now, it has revealed itself. It’s a way to ask your friends questions.

Watch the video and be not amazed. Watch as, for the first time ever, a dude takes a picture of a tree in the woods and sends it to someone else because he doesn’t know what he’s looking at—Yahoo! Answers for the bourgeoisie.

Have you ever posted on Facebook, asking if anyone knows a good barber? Or tweeted to your followers asking if “House of Cards” is any good? That’s Jelly—a search engine that uses your friends—only more convoluted than ever before. […]

Jelly says “it’s not hard to imagine that the true promise of a connected society is people helping each other.” This truly is a revolution in engorged, cloying, dumbstruck rhetoric, a true disruption of horse shit. With Jelly, “you can crop, reframe, zoom, and draw on your images to get more specific”—you can also do that with countless other apps. But that doesn’t matter—this is a vanity project, remember. It’s an opportunity for Biz Stone to Vimeopine on the nature of human knowledge, interconnectedness, and exotic flora. It’s an app for the sake of apps—a software Fabergé egg.