shit talkers

If you are an IPO company founder and — even more explicitly — you are Facebook CEO Mark Zuckerberg, you want your share price on the first day to go exactly nowhere, which is what Facebook did. That means no money was left on the table and the company got the best possible deal.

Zuckerberg didn’t and doesn’t care about investors in this scenario. He just doesn’t give a damn. Investment bankers do give a damn because they’d like to have another IPO next week or next month and have that go very well, too. Zuckerberg expects Facebook to never issue another share of stock. He’s done raising money thanks, and on his honeymoon.

I’m sure there was a struggle at the end over how to price the offering. The bankers would have preferred $34 or even $32, but Facebook went for $38 and they were correct to do so from their point of view because we now see it was the optimal solution.

{ Cringely | Continue reading }

As Facebook shares continued their slide, regulators launched inquiries into whether privileged Wall Street insiders were alerted to the company’s weakening financial projections, leading them to shun the stock or dump shares just as buying was opened to the public. […]

SEC Chairwoman Mary Schapiro said the agency will examine “issues” into the bungled Facebook public offering. […]

The legal issue raised could be “securities fraud — plain and simple,” said Ernest Badway, a securities lawyer in New York and New Jersey and a former enforcement attorney at the U.S. Securities and Exchange Commission.

{ LA Times | Continue reading }

One mutual fund source said they had never, in a decade of experience, seen an underwriter cut a company’s outlook during the road show prior to an offering. […]

Brokers who over-ordered shares in the expectation that supply would be limited continued to complain they received too much stock to handle and were left in the dark about forecast changes.

{ The Age | Continue reading }

photo { Victor Cobo }

economics, shit talkers | May 23rd, 2012 5:48 am

The lawyers for Goldman and Bank of America/Merrill Lynch have been involved in a legal battle for some time – primarily with the retail giant Overstock.com, but also with Rolling Stone, the Economist, Bloomberg, and the New York Times. The banks have been fighting us to keep sealed certain documents that surfaced in the discovery process of an ultimately unsuccessful lawsuit filed by Overstock against the banks.

Last week, the banks’ lawyers, apparently accidentally, filed an unredacted version of Overstock’s motion as an exhibit in their declaration of opposition to that motion. In doing so, they inadvertently entered into the public record a sort of greatest-hits selection of the very material they’ve been fighting for years to keep sealed. […]

“Fuck the compliance area – procedures, schmecedures,” chirps Peter Melz, former president of Merrill Lynch Professional Clearing Corp. (a.k.a. Merrill Pro), when a subordinate worries about the company failing to comply with the rules governing short sales. […]

There are even more troubling passages, some of which should raise a few eyebrows, in light of former Goldman executive Greg Smith’s recent public resignation, in which he complained that the firm routinely screwed its own clients and denigrated them (by calling them “Muppets,” among other things).

{ Rolling Stones | Continue reading }

economics, shit talkers | May 16th, 2012 2:29 pm

Drawing on the metaphor of ‘Prozac’, Prozac leadership encourages leaders to believe their own narratives that everything is going well and discourages followers from raising problems or admitting mistakes. Prozac is used to denote and symbolize a widespread social addiction to excessive positivity. Problems can occur, particularly if this positivity is seen to be discrepant with everyday experience. For example, if leaders repeatedly promise that ‘things can only get better’ but over time this does not happen, followers can become increasingly sceptical and cynical. This article warns that Prozac leadership, whether in corporate, political or other settings, can damage performance by eroding trust, communication, learning and preparedness.

{ SAGE | Continue reading }

photo { Erik Wåhlström }

psychology, shit talkers | May 2nd, 2012 7:55 am

Six studies demonstrate the “pot calling the kettle black” phenomenon whereby people are guilty of the very fault they identify in others. Recalling an undeniable ethical failure, people experience ethical dissonance between their moral values and their behavioral misconduct. Our findings indicate that to reduce ethical dissonance, individuals use a double-distancing mechanism. Using an overcompensating ethical code, they judge others more harshly and present themselves as more virtuous and ethical.

{ Journal of Experimental Psychology: General | PDF | via Overcoming Bias }

related { Psychological projection is a psychological defense mechanism where a person subconsciously denies his or her own attributes, thoughts, and emotions, which are then ascribed to the outside world, usually to other people. | Wikipedia }

ideas, psychology, shit talkers | April 3rd, 2012 12:12 pm

Chances are pretty good you’ve recently seen the “Banksy on Advertising” quote that begins, “People are taking the piss out of you everyday.” The passage is from Banksy’s 2004 book Cut It Out, and it presents the idea that if advertisers are going to fill your world with ads, you have every right to “take, re-arrange and re-use” those images without permission. The quote has been posted widely on Facebook, Tumblr, and Twitter, which is where I found it.

Here’s the interesting part:

Most of it is swiped directly from an essay I wrote in 1999.

{ Reading Frenzy | Continue reading }

buffoons | March 11th, 2012 3:12 pm

buffoons, haha, marketing | January 8th, 2012 11:18 am

Exaggeration means to make something seem larger, better, worse, etc than it really is. It is beyond limits of truth that creates doubt. It is a negative factor. So everybody is afraid of it. But nobody can avoid it. It causes irritation. It causes annoyance. Thus exaggerated remarks ultimately aggravate the target person. A fool or a wicked person exaggerates. A wise person neither fabricates the fact nor manufactures a new one. Similarly an innocent soul describes a fact unchanged and states it as it is.

Human nature is to exaggerate to gain something. This gain may either be classical or commercial or both simultaneously. Everybody tries to magnify his good traits and minimize his faults thus to win both ways. Emotion makes one blind. It kills clarity of thought. It escorts a lover in the kingdom of romance, far from the madding crowd. Emotion of the lover exaggerates the good traits of his fiancée hundred times and allures to love her. Later on when emotion is replaced by reality then faults of fiancée are exaggerated thousand times automatically and compel him to depart her mercilessly. Both of these events are striking examples of exaggeration and happen at the beckon of emotion. Exaggeration when is rendered for mere enjoyment, there lies no problem. At that jovial moment fact is fabricated and colored as per the sweet will of the narrators. Each of the narrators joins the competition of exaggeration. Since, they have no base and no brake at all, they stretch the truth with immense power of imagination. But it is too bad if this is used as a weapon to defame or harm to others.

Man beats his own drum with much intensity to gain name, fame and win the game. Due to exaggeration original story remains a mystery. As such they say, in history the names are real but the fact is either full of intentional exaggeration or suppression or both. So it is the topic of research to the scholars to find out the truth. Problem arises if a single topic is exaggerated differently by different scholars.

{ Dibakar Pal, Of Exaggeration, 2011 | SSRN | Continue reading }

ideas, shit talkers | July 15th, 2011 2:49 pm

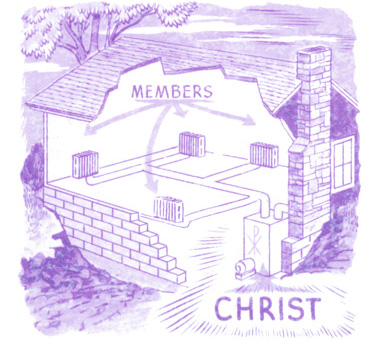

How Flawed is the Nation’s Most Watched Economic Indicator

Last October, when the government released its monthly tally of how many people had jobs, there was a collective groan. The September report, which came out the first Friday in October, said the number of employed people in the U.S. had dropped by 95,000, worse than the 57,000 job drop the month before. After looking like we had finally hit an economic rebound, the jobs market was again slipping back again perhaps toward the dreaded double-dip recession. Or was it?

A month later the Bureau of Labor Statistics, which tracks and releases the employment numbers for the government, revised its jobs count for September. In fact, the economy, it turned out, had lost only 41,000 jobs that month. Is that right? Actually no. A month later, the BLS revised the number again. The final tally: In September, the number of people working in America fell by just 24,000. So the economy was improving? Not quite. Remember that month before figure of 57,000 jobs lost. Yeah, well, that was wrong, too, off by nearly all of the drop, or 56,000 jobs.

{ Time | Continue reading }

illustration { Joe Heaps }

economics, shit talkers | July 8th, 2011 9:00 am

Over the years Dr Ernst and his group have run clinical trials and published over 160 meta-analyses of other studies. (Meta-analysis is a statistical technique for extracting information from lots of small trials that are not, by themselves, statistically reliable.) His findings are stark.

According to his “Guide to Complementary and Alternative Medicine”, around 95% of the treatments he and his colleagues examined—in fields as diverse as acupuncture, herbal medicine, homeopathy and reflexology—are statistically indistinguishable from placebo treatments.

In only 5% of cases was there either a clear benefit above and beyond a placebo (there is, for instance, evidence suggesting that St John’s Wort, a herbal remedy, can help with mild depression), or even just a hint that something interesting was happening to suggest that further research might be warranted.

{ The Economist | Continue reading }

health, shit talkers | May 24th, 2011 4:02 pm

Five reasons why I’m not buying Facebook

Excuse me for raining on the Facebook parade, but the $450 million investment by Goldman Sachs and $50 million from Russia’s Digital Sky Technology didn’t move me the way it seemed to move others. This despite the suggested $50 billion valuation, as big and beautiful a number as the stock market has seen in some time.

I am certainly not moved in the same way it appears to have moved Goldman’s own clients: the Wall Street firm has pledged to line up another $1.5 billion in sales to its high net worth investors, who are said to be champing at the bit to get a piece of the action, which starts with a $2 million minimum. Not that I have $2 million lying around, but I wouldn’t buy this stock if I did.

Reason #1: Someone who knows a lot more than I do is selling. While the identities of the specific sellers remain unknown, the current consensus seems to be that most will be from venture capital investors like Accel Partners, Peter Thiel, and Greylock Partners. Maybe Mark Zuckerberg will kick in $50 million or so himself, just for some fooling around money. (…) The way the social network is talked about these days, it’s the best investment opportunity in town. So why would anyone want to forsake it? And don’t give me that crap about VCs being “early stage” and wanting to cash out of a “mature” investment. These people are as money hungry as any other institutional investor, and would let it ride unless….they saw something that suggested that the era of stupendous growth was over. Facebook reached 500 million users in July. There’s been no update since, even though the company had meticulously documented every new 50 million users to that point. Might the curve have crested? And let’s not even talk about the fact that they don’t really make much money per user — a few dollars a year at most. (Its estimated $2 billion in 2010 revenues would amount to $4 per user at that base.)

Reason #2: Goldman Sachs. I’ve got nothing against Goldman Sachs. Hell, I worked there. But when Reuters’ Felix Salmon says that the Goldman investment “ratifies” a $50 billion valuation, he’s only half right. That is, someone, somewhere—perhaps the Russians at DST Global—might just believe this imaginary number. (It’s hard to see why, though: DST got in at a $10 billion valuation in May 2009. Facebook’s user base has more than doubled since then. So its valuation should…quintuple?) But concluding that Goldman Sachs believes in a $50 billion valuation is poor reasoning. (…)

Reason #5: Warren Buffett cautions those looking at outsize valuations to consider one’s purchase of company stock in a different way than price of an individual share, whatever it may be. He suggests one look at the total market valuation – in this case, a sketchy $50 billion – and to consider: Would you buy the whole company for that price, if you had the money? The market value of Goldman Sachs is just $88 billion. I’d take more than half that company over the whole of Facebook any day of the week.

{ Duff McDonald/CNN Money | Continue reading }

related { For News Sites, Google Is the Past and Facebook Is the Future | Google’s stealth multi-billion-dollar business }

and { The Next 10 Years Will Be Great For Both Founders And VCs }

buffoons, economics, social networks | May 10th, 2011 6:57 pm

Meet Donald Trump’s bankers. Like the characters in the fairy tale The Emperor’s New Clothes, a gaggle of major financial institutions has finally been forced to admit, after lending Trump billions of dollars, that there’s a lot less to the emperor — or at least his empire — than the banks had believed.

Not quite nine months after bailing out Trump with a rescue package that gave him $65 million in new loans and eased credit terms on his bank debt, Trump’s bankers last week stopped the game. Already more than $3.8 billion in the hole and sliding perilously close to a mammoth personal bankruptcy, the brash New York developer had no choice but to accept the dismantling of his vast holdings.

{ Time, May 1991 | Continue reading }

related { Trump Unable To Produce Certificate Proving He’s Not A Festering Pile Of Shit }

unrelated { Why is the Federal Reserve forking over $220 million in bailout money to the wives of two Morgan Stanley bigwigs? }

U.S., economics, flashback, shit talkers | April 27th, 2011 2:59 pm

Preventing preterm births just got 150 times more expensive, now that KV Pharmaceuticals has gained exclusive rights to produce a progesterone shot used to prevent premature births in high-risk mothers.

Although the shot has been available in unregulated form from specialty compounding pharmacies for years for $10 a pop, the Food and Drug Administration recently granted KV Pharmaceuticals sole rights to produce the drug, which will be marketed as Makena and cost $1,500 per dose — an estimated $30,000 in total per pregnancy. (…)

Because FDA laws prohibit compounding pharmacies from making FDA-approved products, doctors will be legally obligated to stop using the cheaper version of this drug.

{ ABC News | Continue reading }

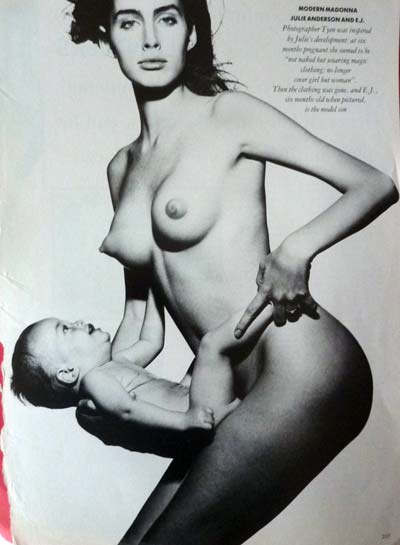

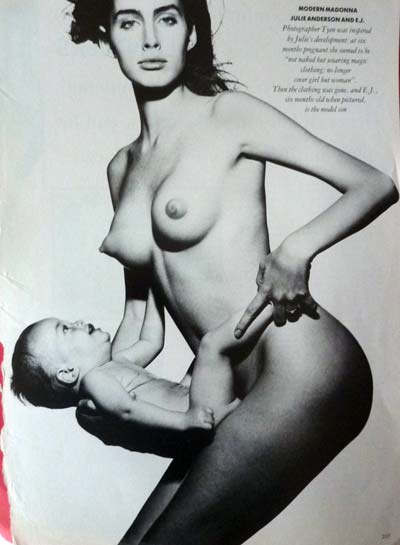

photo { Julie Anderson and E.J. photographed by Tyen }

buffoons, economics, health | March 14th, 2011 6:05 pm

Not only do insincere apologies fail to make amends, they can also cause damage by making us feel angry and distrustful towards those who are trying to trick us into forgiving them.

Even sincere apologies are just the start of the repair process. Although we expect the words “I’m sorry” to do the trick, they don’t do nearly as much as we expect.

{ PsyBlog | Continue reading }

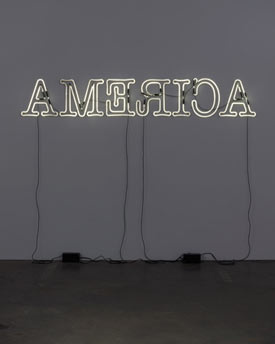

photo { Richard Misrach }

psychology, relationships, shit talkers | March 1st, 2011 8:08 pm

“Oh my God, I’m more naked that I was in Playboy,” Kim Kardashian told her sisters. “I’m so mad right now. [The magazine] promised I would be covered with artwork — you can see the nipples!”

“The whole concept was sold to me that nothing would be seen,” she continued. “I feel so taken advantage of … I’ve definitely learned my lesson. I’m never taking my clothes off again, even if it’s for Vogue.”

This wasn’t the first time Kim was upset over nude photos — when her Playboy spread came out, she similarly was upset, telling Harper’s Bazaar… (…) Then, she posed nude for Bazaar.

{ Huffington Post | Continue reading }

photo { Zoe Strauss }

celebs, shit talkers, weirdos | February 2nd, 2011 11:00 am

FRIEND: so have you decided what you are going to do about the websites?

ZUCK: yea i’m going to fuck them

ZUCK: probably in the year

ZUCK: *ear

In another exchange leaked to Silicon Alley Insider, Zuckerberg explained to a friend that his control of Facebook gave him access to any information he wanted on any Harvard student:

ZUCK: yea so if you ever need info about anyone at harvard

ZUCK: just ask

ZUCK: i have over 4000 emails, pictures, addresses, sns

FRIEND: what!? how’d you manage that one?

ZUCK: people just submitted it

ZUCK: i don’t know why

ZUCK: they “trust me”

ZUCK: dumb fucks

According to two knowledgeable sources, there are more unpublished IMs that are just as embarrassing and damaging to Zuckerberg. But, in an interview, Breyer told me, “Based on everything I saw in 2006, and after having a great deal of time with Mark, my confidence in him as C.E.O. of Facebook was in no way shaken.”

{ New Yorker | Continue reading }

shit talkers, technology | December 2nd, 2010 8:10 pm

I hate to be the one to tell you this, but there’s a whole range of phrases that aren’t doing the jobs you think they’re doing.

In fact, “I hate to be the one to tell you this” (like its cousin, “I hate to say it”) is one of them. Think back: How many times have you seen barely suppressed glee in someone who — ostensibly — couldn’t be more reluctant to be the bearer of bad news? A lack of respect from someone who starts off “With all due respect”? A stunning dearth of comprehension from someone who prefaces their cluelessness with “I hear what you’re saying”? And has “I’m not a racist, but…” ever introduced an unbiased statement?

These contrary-to-fact phrases have been dubbed (by the Twitter user GrammarHulk and others) “but-heads,” because they’re at the head of the sentence, and usually followed by but. They’ve also been dubbed “false fronts,” “wishwashers,” and, less cutely, “lying qualifiers.”

The point of a but-head is to preemptively deny a charge that has yet to be made, with a kind of “best offense is a good defense” strategy. This technique has a distinguished relative in classical rhetoric: the device of procatalepsis, in which the speaker brings up and immediately refutes the anticipated objections of his or her hearer. When someone says “I’m not trying to hurt your feelings, but…” they are maneuvering to keep you from saying “I don’t believe you — you’re just trying to hurt my feelings.”

Once you start looking for these but-heads, you see them everywhere, and you see how much they reveal about the speaker. When someone says “It’s not about the money, but…”, it’s almost always about the money. If you hear “It really doesn’t matter to me, but…”, odds are it does matter, and quite a bit. Someone who begins a sentence with “Confidentially” is nearly always betraying a confidence; someone who starts out “Frankly,” or “Honestly,” “To be (completely) honest with you,” or “Let me give it to you straight” brings to mind Ralph Waldo Emerson’s quip: “The louder he talked of his honor, the faster we counted our spoons.”

{ Boston Globe | Continue reading }

ideas, shit talkers | November 22nd, 2010 11:44 am

In the financial markets, a lot rides on the word of a company’s top executives. If a CEO tells a lie, a lot of shareholders can get hurt.

Now, after studying thousands of corporate earnings calls, two researchers from Stanford University think they’ve come up with a way to tell when senior executives are fibbing.

It’s a question that people have been wrestling with for as long as humans have been interacting with each other.

“I think since the Garden of Eden we’ve been trying to figure this out — who’s lying and who’s not lying,” says David Larcker, a professor of accounting at Stanford’s Graduate School of Business. (…)

Kumar was asked, “Can your books be trusted?” And he replied by saying, “We hire the very best auditors.” Larcker says that can be a big warning sign.

“You basically are not answering the question. You’re basically making reference to somebody else, and those are the kinds of things in psychology you look for,” he says. (…)

Zakolyukina says lying executives tend to overuse words like “we” and “our team” when they talk about their company. They avoid saying “I.” (…) Lying CEOs also tend to use a lot of words that express positive emotion — things are fabulous and fantastic and extraordinary.

{ NPR | Continue reading }

related { Twitter Mood Predicts The Stock Market }

photo { Richard Avedon }

avedon, economics, psychology, shit talkers | October 20th, 2010 7:35 am

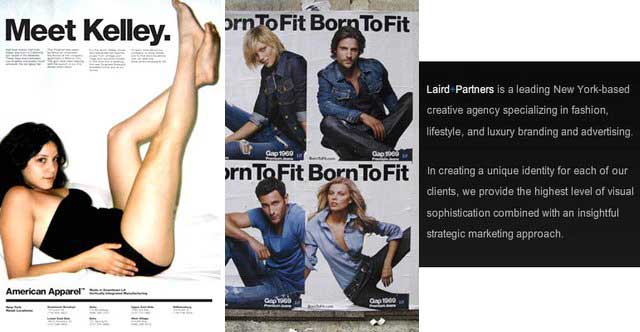

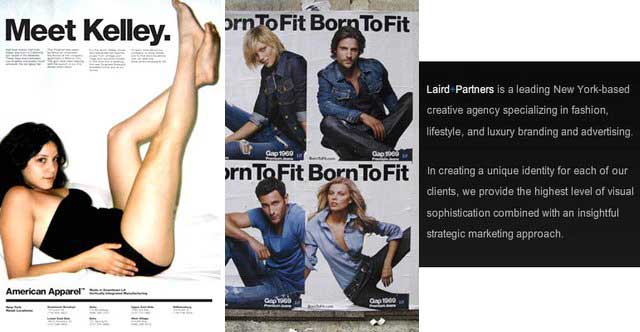

A new logo for Gap that debuted to much criticism Wednesday might not be the perfect fit, Bill Chandler, vice president of corporate communications of Gap, tells Co.Design. “We love the design, but we’re open to other ideas and we want to move forward with the best logo possible,” he says.

Chandler confirmed last night’s message from Gap’s Facebook account (using the old logo as their avatar), which announced the new logo is actually part of a crowdsourcing project. He would not say when — before or after the tidal wave of criticism — Gap decided to participate in one of the most contentious practices in design, in which regular Joes and Janes compete to create a logo that’s better than the one made by a professional. The logo itself was not a PR stunt, Chandler says.

The new logo was designed by Trey Laird and his firm Laird and Partners, who have served as Gap’s creative directors for many years.

{ Fast Company | Continue reading | AdAge | Read more }

previously:

{ left to right: American Apparel ad 2005, Gap ad 2009, Laird+Partners About us page }

marketing, shit talkers | October 8th, 2010 8:10 am

David Larcker and Anastasia Zakolyukina of Stanford’s Graduate School of Business analysed the transcripts of nearly 30,000 conference calls by American chief executives and chief financial officers between 2003 and 2007. They noted each boss’s choice of words, and how he delivered them. They drew on psychological studies that show how people speak differently when they are fibbing, testing whether these “tells” were more common during calls to discuss profits that were later “materially restated”, as the euphemism goes. They published their findings in a paper called “Detecting Deceptive Discussions in Conference Calls”.

Deceptive bosses, it transpires, tend to make more references to general knowledge (“as you know…”), and refer less to shareholder value (perhaps to minimise the risk of a lawsuit, the authors hypothesise). They also use fewer “non-extreme positive emotion words”. That is, instead of describing something as “good”, they call it “fantastic”. The aim is to “sound more persuasive” while talking horsefeathers.

When they are lying, bosses avoid the word “I”, opting instead for the third person. They use fewer “hesitation words”, such as “um” and “er”, suggesting that they may have been coached in their deception.

{ The Economist | Continue reading }

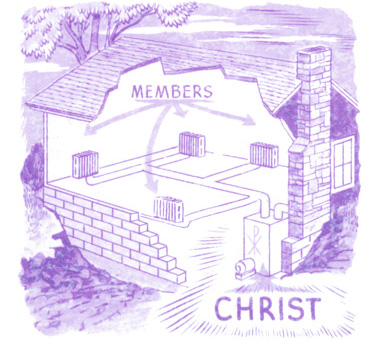

installation { Sebastian Wickeroth, Strategie der Steine 3, Junger Westen, Kunsthalle Recklinghausen, 2007 }

economics, psychology, shit talkers | September 18th, 2010 8:40 am

Kent Kiehl has studied hundreds of psychopaths. Kiehl is one of the world’s leading investigators of psychopathy and a professor at the University of New Mexico. He says he can often see it in their eyes: There’s an intensity in their stare, as if they’re trying to pick up signals on how to respond. But the eyes are not an element of psychopathy, just a clue.

Officially, Kiehl scores their pathology on the Hare Psychopathy Checklist, which measures traits such as the inability to feel empathy or remorse, pathological lying, or impulsivity.

“The scores range from zero to 40,” Kiehl explains in his sunny office overlooking a golf course. “The average person in the community, a male, will score about 4 or 5. Your average inmate will score about 22. An individual with psychopathy is typically described as 30 or above. Brian scored 38.5 basically. He was in the 99th percentile.”

“Brian” is Brian Dugan, a man who is serving two life sentences for rape and murder in Chicago. (…)

Dugan is smart — his IQ is over 140 — but he admits he has always had shallow emotions. He tells Kiehl that in his quarter century in prison, he believes he’s developed a sense of remorse.

“And I have empathy, too — but it’s like it just stops,” he says. “I mean, I start to feel, but something just blocks it. I don’t know what it is.”

Kiehl says he’s heard all this before: All psychopaths claim they feel terrible about their crimes for the benefit of the parole board.

“But then you ask them, ‘What do you mean, you feel really bad?’ And Brian will look at you and go, ‘What do you mean, what does it mean?’ They look at you like, ‘Can you give me some help? A hint? Can I call a friend?’ They have no way of really getting at that at all,” Kiehl says.

Kiehl says the reason people like Dugan cannot access their emotions is that their physical brains are different. And he believes he has the brain scans to prove it.

{ NPR | Continue reading }

image { Richard Boulet }

brain, psychology, shit talkers, weirdos | September 18th, 2010 8:39 am