U.S.

{ The bathroom, which became unisex over time. Serge Becker, Area’s art director: “We beat out a door at some point between the men’s and women’s room and ended up just leaving it.” }

{ Dolph Lundgren and Grace Jones at Area’s confinement-themed party }

{ Invitation for the Natural History party | Photos from Area: 1983–1987 | More: Inside Area Club }

flashback, new york | November 5th, 2013 2:46 pm

By 1790, the new republic was in arrears on $11,710,000 in foreign debt. These were obligations payable in gold and silver. Alexander Hamilton, the first secretary of the Treasury, duly paid them. In doing so, he cured a default.

Hamilton’s dollar was defined as a little less than 1/20 of an ounce of gold. So were those of his successors, all the way up to the administration of Franklin D. Roosevelt. But in the whirlwind of the “first hundred days” of the New Deal, the dollar came in for redefinition. The country needed a cheaper and more abundant currency, FDR said. By and by, the dollar’s value was reduced to 1/35 of an ounce of gold.

By any fair definition, this was another default. Creditors both domestic and foreign had lent dollars weighing just what the Founders had said they should weigh. They expected to be repaid in identical money. […]

The lighter Roosevelt dollar did service until 1971, when President Richard M. Nixon lightened it again. In fact, Nixon allowed it to float. No longer was the value of the greenback defined in law as a particular weight of gold or silver. It became what it looked like: a piece of paper.

Yet the U.S. government continued to find trusting creditors. Since the Nixon default, the public’s holdings of the federal debt have climbed from $303 billion to $11.9 trillion.

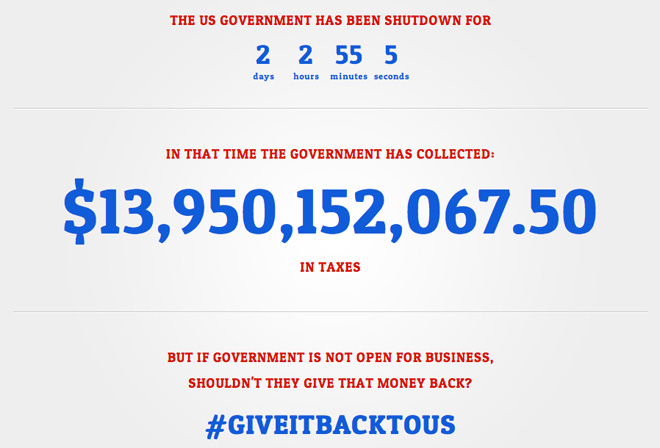

If today’s political impasse leads to another default, it will be a kind of technicality. Sooner or later, the Obama Treasury will resume writing checks. The question is what those checks will buy.

{ Jim Grant/Zero Hedge | Continue reading }

art { Luigi Serafini }

U.S., economics, flashback | October 12th, 2013 10:06 am

U.S., economics, law, technology | October 3rd, 2013 2:02 pm

Sex and the City’s antepenultimate episode… […] This was the episode in which gauche, chain-smoking “Page Six” staple “Lexi Featherston” did some coke at a geriatric party, yelled, “This used to be the most exciting city in the world, and now it’s nothing but smoking near a fuckin’ open window,” and then took a header out said window. […]

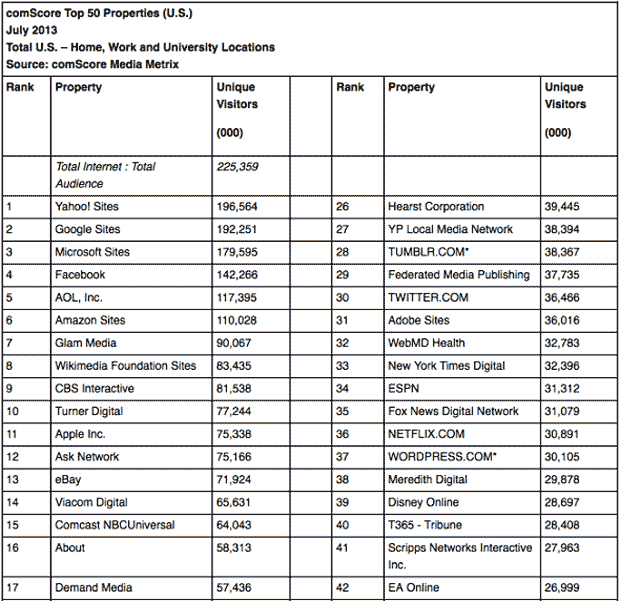

Minimum estimates now put the number of New York City millionaires at around 400,000; there could be as many as 650,000. […] It’s a bedrock pillar of nickels and dimes all the way down, a billion fees a second, a burn rate, a waste, a dick joke, a $40,000 storefront in Brooklyn, one more year of fat bonus before you say you’ll finally quit, one more “space” disrupted, a Balthazar breakfast, a billion uniques, a whale, a Citation X, an acquisition, a bomb, a deposition, a bust.

{ Choire Sicha/NY Magazine | Continue reading }

experience, new york | September 28th, 2013 7:57 pm

“Chris,” a Chicago high school student and gang member and gunslinger, explains exactly how easy it is for he and his fellow gang members to obtain firearms, even if they have criminal records:

“I will make a call and say I need a gun. I will ride down the street on my bike and get it — five minutes.” . . . Chris calls them the “gun guys.” The cops have another name for them: “straw purchasers.”

“Gun guys” have clean records allowing them to obtain Illinois firearm owner’s identification cards. With FOID cards, they can legally buy guns at stores in the suburbs.

Then they illegally sell them to gang members banned from owning guns because of their criminal backgrounds.

Most of the guns recovered in crimes in Chicago were bought in suburban gun stores, according to a new University of Chicago Crime Lab study of police gun-trace data.

As Chris points out, many of these straw purchasers’ full-time job is trading on their clean criminal record to buy guns and then resell them at a markup to dangerous felons. Such professional straw purchasers should be easy to catch. Because federal law requires most gun purchasers to undergo criminal background checks before they can buy a firearm, it should be an easy matter for law enforcement to check whether the same person is purchasing guns over and over and over again.

Except that the so-called “Tiahrt Amendments” thwart such checks by requiring the Justice Department to destroy the record of any gun buyer whose purchase was approved within 24 hours. As a result, law enforcement is often blind to straw purchasers who are flooding the streets with guns right under their noses.

Nor is this the only aspect of federal law that “gun guys” can take advantage of. An estimated 10 percent of all guns used in a crime by juveniles were sold at a gun show or flea market where many of the dealers do not have to conduct criminal background checks on their customers. Indeed, federal officials are often forced to charge straw purchasers with paperwork violations due to the absence of an appropriate law criminalizing unlicensed gun trafficking.

{ Think Progress | Continue reading }

related { Another responsible gun owner just doing his thing }

U.S., guns, law | September 2nd, 2013 12:09 pm

And so the housing “recovery” comes to a screeching halt, which is not surprising as there never was a recovery to begin with. Moments ago cheerleaders of the second housing bubble were shocked to learn that in July a tiny 35K new houses were sold (with just 3K sold in the Northeast, and just 19K in the otherwise strong South), of which 13K houses were not even started. This translated into a puny 394K seasonally adjusted annualized sales, missing expectations of 487K by nearly a massive 100K, and in addition the June print was revised much lower from 497K to 455K (which back in July beat expectations of 484K and was trumpeted as the highest print since 2008 - so much for that). Yet one thing that did not change is that the median home sale price decline continued, and in July dropped to $257.2K down from $258.5.

{ Zero Hedge | Continue reading }

U.S., housing | August 23rd, 2013 2:58 pm

U.S., technology | August 21st, 2013 3:53 pm

CL > new york > queens > all personals > missed connections

Seen on the N Train to Queensboro…..did we have something? - w4m - 26 (queens)

Posted: 2013-08-08, 9:22PM EDT

I got on at Union Square, you were already seated on the train. Actually, you were kind of sprawled halfway under one of the seats, sort of lying on the floor. I liked your style. Most people just sit on the seats. I can tell you see things differently.

Me, wearing a flared denim vintage skirt, white blouse, glasses. Small red pillbox hat. You, smooth-looking skin, distant stare. Kind of pale grey complexion. I kept trying to catch your eye over my copy of Damien Hirst’s biography, but you were preoccupied with something else.

You seemed like you had such faraway eyes. Black eyes. Like a doll’s eyes. What’s behind those eyes? I’d love to find out. I like the Discovery Channel, romantic movies, bicycles, picnics in the park, and deep-sea fishing. I got off at Queensboro, but I’m still wishing I’d said hello. Can we go for sushi sometime? Drop me a line.

{ craigslist | Continue reading }

background reading { Early on Aug. 8 ,2013 in New York the conductor aboard a Ditmars-bound N train at Queensboro Plaza reported a shark aboard the train in car }

new york, underground | August 9th, 2013 11:11 am

Darius McCollum has been arrested 29 times over the past 30 years for a series of transit-related crimes ranging from impersonating subway workers to stealing buses. […]

He first drew notice in 1981, when as a 15-year-old he operated an E train six stops from 34th Street to the World Trade Center without the conductor or passengers reporting anything amiss.

{ WSJ | Continue reading }

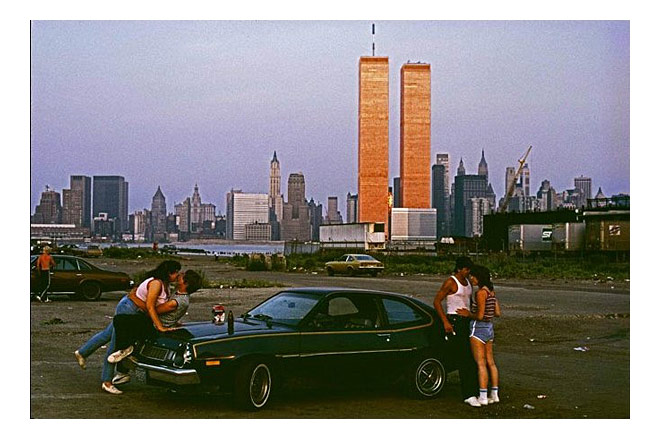

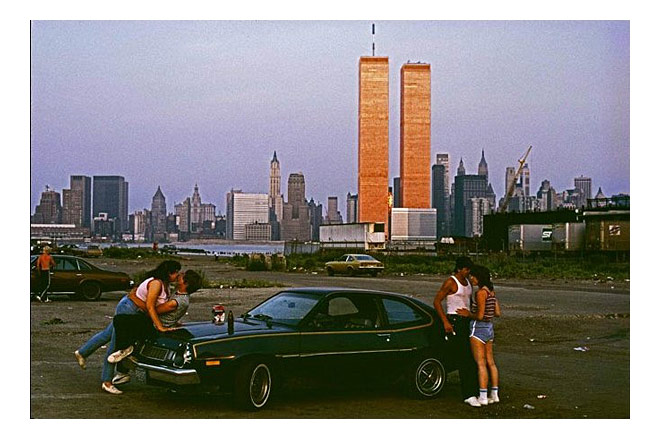

photo { Thomas Hoepker, Lover’s Lane, New Jersey, 1983 }

motorpsycho, new york, transportation | July 17th, 2013 8:23 am

Amerigo Vespucci (1454 – 1512) was an Italian explorer, financier, navigator and cartographer who first demonstrated that Brazil and the West Indies did not represent Asia’s eastern outskirts as initially conjectured from Columbus’ voyages, but instead constituted an entirely separate landmass hitherto unknown to Afro-Eurasians.

Colloquially referred to as the New World, this second super continent came to be termed “America,” probably deriving its name from the feminized Latin version of Vespucci’s first name.

{ Wikipedia | Continue reading }

U.S., flashback | July 9th, 2013 4:50 am

Horne, a raisin farmer, has been breaking the law for 11 solid years. He now owes the U.S. government at least $650,000 in unpaid fines. And 1.2 million pounds of unpaid raisins, roughly equal to his entire harvest for four years.

His crime? Horne defied one of the strangest arms of the federal bureaucracy — a farm program created to solve a problem during the Truman administration, and never turned off. […]

It works like this: In a given year, the government may decide that farmers are growing more raisins than Americans will want to eat. That would cause supply to outstrip demand. Raisin prices would drop. And raisin farmers might go out of business.

To prevent that, the government does something drastic. It takes away a percentage of every farmer’s raisins. Often, without paying for them.

These seized raisins are put into a government-controlled “reserve” and kept off U.S. markets.

{ Washington Post | Continue reading }

illustration { occasional head bunts }

U.S., economics, food, drinks, restaurants | July 8th, 2013 6:43 am

When she became pregnant, Ms. Martin called her local hospital inquiring about the price of maternity care; the finance office at first said it did not know, and then gave her a range of $4,000 to $45,000. […]

Like Ms. Martin, plenty of other pregnant women are getting sticker shock in the United States, where charges for delivery have about tripled since 1996, according to an analysis done for The New York Times by Truven Health Analytics. Childbirth in the United States is uniquely expensive, and maternity and newborn care constitute the single biggest category of hospital payouts for most commercial insurers and state Medicaid programs. […]

The average total price charged for pregnancy and newborn care was about $30,000 for a vaginal delivery and $50,000 for a C-section, with commercial insurers paying out an average of $18,329 and $27,866, the report found. […]

Two decades ago, women typically paid nothing other than a small fee if they opted for a private hospital room or television.

{ NY Times | Continue reading }

U.S., economics, health, kids | July 1st, 2013 8:37 am

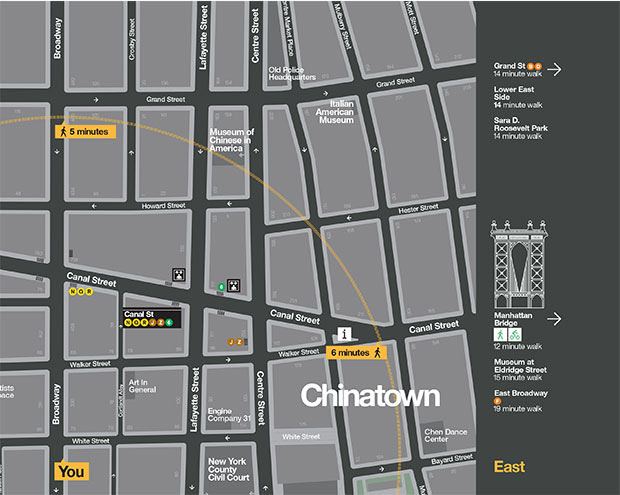

new york, visual design | June 26th, 2013 11:26 am

The unavoidable truth is that sea levels are rising and Miami is on its way to becoming an American Atlantis. It may be another century before the city is completely underwater (though some more-pessimistic scientists predict it could be much sooner), but life in the vibrant metropolis of 5.5 million people will begin to dissolve much quicker, most likely within a few decades. […]

South Florida is not the only place that will be devastated by sea-level rise. London, Boston, New York and Shanghai are all vulnerable, as are low-lying underdeveloped nations like Bangladesh. But South Florida is uniquely screwed, in part because about 75 percent of the 5.5 million people in South Florida live along the coast. And unlike many cities, where the wealth congregates in the hills, southern Florida’s most valuable real estate is right on the water.

{ Rolling Stones | Continue reading }

related { Global warming has slowed. The rate of warming of over the past 15 years has been lower than that of the preceding 20 years. There is no serious doubt that our planet continues to heat, but it has heated less than most climate scientists had predicted. | The Economist }

U.S., climate, temperature, water | June 25th, 2013 11:44 am

Tim Cook […] reminded a Senate subcommittee that Apple is investing $100 million to make some of its Macintosh computers in the U.S. […] The operation, to be based in Texas, will be Apple’s first domestic assembly foray since 2004, and other technology manufacturers are moving jobs onshore. Google Inc.’s Motorola Mobility, for example, also plans to assemble smartphones in Texas.

It’s not all public relations: These companies are taking advantage of low energy costs and a decade of wage stagnation, which has made U.S. factory jobs more competitive with those in China, where wages are rising.

{ Bloomberg | Continue reading }

U.S., asia, economics | June 14th, 2013 1:20 pm

U.S. stocks fell on Wednesday, with the Dow sliding more than 100 points.

The Dow is now riding a three-day losing skid, capped by today’s 126-point drop, marking the first time this year the blue-chip average has suffered three straight down days.

With it all said and done, the Dow went 112 trading days without a three-day losing streak, the longest such stretch in its history. The previous record was set in 1935, when the Dow went 93 trading days without three straight down days.

{ WSJ | Continue reading }

Perhaps most notable is that the number of companies hitting 52 week lows surged to the highest since October 2011.

{ ZeroHedge | Continue reading }

U.S., economics | June 12th, 2013 3:33 pm

Having just returned alive from my first visit to Las Vegas, I feel the need to share some of my experiences, observations, and enlightening commentary. […] The place really is just that bad. Las Vegas is essentially the combined horror of Hell, the Holocaust, and the killing fields of Cambodia ground up and run through a giant neon sausage maker. […] Las Vegas was obviously designed by a retarded child and bankrolled by a shadowy cabal of Nazis, mafia gangsters, racist astronauts, pedophiles, murderers, and Celine Dion. I can’t imagine any other place in the world that would make heroes out of creepy immigrants like Zigfried and Roy, or glorify washed up actors, comedians, and musicians as Gods of the Universe.

{ Something Awful | Continue reading }

vegas | June 10th, 2013 1:34 am

U.S., economics | June 10th, 2013 1:28 am

flashback, new york | June 10th, 2013 1:22 am

The airwaves are full of stories of economic recovery. One trumpeted recently has been the rapid recovery in housing, at least as measured in prices.

The problem is, a good portion of the rebound in house prices in many markets has less to do with renewed optimism, new jobs, and rising wages, and more to do with big money investors fueled by the ultra-cheap money policies of the Fed.

On my recent trip to Salt Lake City, Utah, after presenting to a bi-partisan audience in the Capitol building, a gentleman came up to me and introduced himself as a real estate agent. He explained that he’d been seeing something very strange over the past six months, where very well capitalized, out-of-state private equity funds had been buying up huge swaths of residential real estate with cash.

The effect, not surprisingly, is that regular home buyers are being outbid and eventually priced out of the market. Over time, these full cash offers at the ask get noticed and home sellers begin to raise their asking prices.

{ Chris Martenson/Zero Hedge | Continue reading }

[W]e were surprised to see an article in the very much mainstream, and pro-administration policies NYT, exposing just this facet of the new housing bubble. […]

Blackstone, which helped define a period of Wall Street hyperwealth, has bought some 26,000 homes in nine states. Colony Capital, a Los Angeles-based investment firm, is spending $250 million each month and already owns 10,000 properties. With little fanfare, these and other financial companies have become significant landlords on Main Street. Most of the firms are renting out the homes, with the possibility of unloading them at a profit when prices rise far enough.

{ Tyler Durden/Zero Hedge | Continue reading }

more { The Entire US Housing Market In One Chart }

U.S., housing | June 5th, 2013 11:26 am