incidents

‘I think that commentary and dissent have merged into dysentery by now.’ –Woody Allen

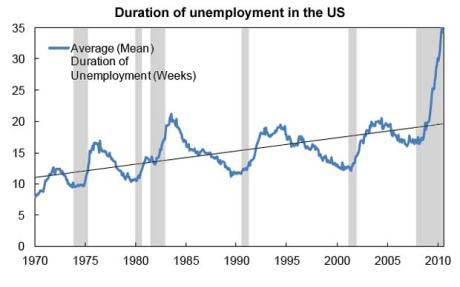

{ America and Europe face the worst jobs crisis since the 1930s and risk “an explosion of social unrest” unless they tread carefully, the International Monetary Fund has warned. | Telegraph | full story }

Then with my double barrel shotgun and a whole box of shells

Four dozen Prince George’s County police cadets had searched a wooded area in Glenn Dale for the BlackBerry of a woman who had been killed in her Upper Marlboro home. They found nothing.

Five days later, a county homicide detective, Benjamin Brown, the lead investigator into the strangulation of Antoinette Renee Chase, started a weekend night shift by driving back to the area. Brown suspected Chase’s husband but needed evidence before he could put him in handcuffs.

Brown, a Boy Scout leader who attained the rank of Eagle Scout, knows maps and Global Positioning System devices. The day of the slaying, the victim’s BlackBerry had made or received a phone call that placed the device within 200 meters of a particular location in Glenn Dale. Brown plugged longitude and latitude coordinates into his GPS device and identified an area about 300 meters from where the cadets had searched.

Behind a strip shopping mall, the detective inspected another wooded area. Nothing. He retreated to the shopping mall’s asphalt and, using a screwdriver, pried open a heavy metal storm drain cover. Then a second. Then a third. Jackpot.

On a ledge, Brown saw a plastic bag. Inside the bag, he found a purse that belonged to Antoinette Chase. At the bottom of the storm drain, Brown spotted another plastic bag, which had water shoes and work gloves. The shoes were the same size as those worn by Antoinette’s husband, Spencer Ellsworth Chase, according to court testimony. The work gloves contained the DNA of both Chases, according to testimony.

photo { Horst P. Horst, Costume for Salvador Dalí’s Dream of Venus, 1939 | The Original Copy: Photography of Sculpture, 1839 to Today | MoMA, NYC, August 1–November 1, 2010}

Then she gets you on her wavelength and she lets the river answer

Humans are dumping more plastic than ever, but not all of it is accumulating in the garbage patches of the Atlantic as expected, scientists reported.

Of the millions of metric tons of plastic produced annually, an enormous proportion ends up as tiny debris in the open ocean. The currents loosely gather it together in vast, swirling ‘garbage patches’ near the surface.

But the amount of floating plastic accumulating in the Atlantic Ocean has remained curiously static over the last two decades, in spite of the fact that plastic waste by humans has increased significantly over the same timeframe, according to a new study published in the journal Science.

“Surprisingly, over the 22-year period of the study (1986-2008) we did not observe an increase in the amount of plastic floating in the western Atlantic in the region where it is most highly concentrated,” said Kara Lavender Law of the Sea Education Association and lead author of the study.

Plastic debris has been accumulating in the world’s oceans for decades, but until recently we have had only a peripheral understanding of its extent.

A major pollutant, plastics have far reaching environmental impacts in the ocean, including entanglement of marine fauna, particle ingestion by seabirds and other organisms, dispersal of invasive species to non-native waters and the transport of organic contaminants.

The researchers discovered that while highest concentrations of plastic debris occurred in an area where ocean-surface currents converge - the North Atlantic Subtropical Gyre - over the last two decades there has not been a substantial increase in the overall amount. (…)

Marine scientist Richard Thompson of the University of Plymouth warns that “while the study clearly shows no consistent trend in the abundance of debris in the North Atlantic subtropical Gyre we should not extrapolate this to other regions. Over the same time period there are reports of plastic accumulating in remote regions including the Antarctic and in substantial quantities in the deep sea.”

photo { 3-ton whale died in Malaysia after ingesting a plastic bag, a rope and a bottle cap. }

Wake this time next year

{ 1. Unsourced image | 2. Maurizio Cattelan, Untitled, 2000 }

‘I’m not trying to make art, I’m trying to make lies, because the truth hurts.’ –Dm Simons

The Gulf Oil Spill Disaster

First, let’s begin with the “good” news. The ecological destruction that was first feared is not going to be as bad as once thought, for a variety of reasons. It is not good, but it is not the unmitigated disaster it could have been.

Edward Overton, PhD, Professor Emeritus, Dept. of Environmental Sciences, LSU, is an expert on oil spills. He was at the Exxon Valdez. The Exxon Valdez (EV) was a big, black, thick tide of oil. The Deepwater Horizon is a much bigger spill: every ten days the amount of the EV spill spewed into the Gulf, from April 20 to July 15. Professor Overton spoke mostly for the record. He is very much a concerned environmentalist, and he is also a very serious scientist.

He reminded us that the Louisiana wetlands are a very important part of the ecological system of the Gulf of Mexico. Oversimplifying, they are the nutrient source for the small animal world which feeds the larger. Without the wetlands much of the Gulf ecosystem dies. If they were destroyed, they would not come back very easily, as without their very root system the land would erode away. Bluntly, oil kills wetlands if it gets into it.

There are only three ways to get rid of an oil spill. You can mechanically remove it, chemically remove it, or burn it. They used all three methods. But not fast enough. The Obama administration dithered while Rome burned. (This is not from Overton.) (…)

What should have been a no-brainer decision to use the Dutch ships was delayed for whatever reason. What should have been a no-brainer decision to waive the water purity rules was delayed beyond reason. My personal opinion. Whoever participated in that decision should be allowed to return to the private sector. They only made the problem of the spill worse. They should not be allowed near the decision-making process again.

Please note, this is no defense of British Petroleum. As noted below, they were extremely negligent, and deserve the costs and more. We just don’t need to compound stupid, incompetent, irresponsible (choose several more adjectives, some with color) corporate acts with dumb government ones.

There is a chemical called Corexit that is a product line of solvents primarily used as dispersants for breaking up oil slicks. It is produced by Nalco Holding Company. Corexit was the most-used dispersant in the Deepwater Horizon oil spill in the Gulf of Mexico, with COREXIT 9527 having been replaced by COREXIT 9500 after the former was deemed too toxic. Oil that would normally rise to the surface of the water is broken up by the dispersant into small globules that can then remain suspended in the water.

In hindsight, Overton thinks the use of Corexit was the correct thing to do. It probably saved the wetlands. But it is not without its own bad effects.

When you put Corexit on an oil slick, the surface oil disperses but also drops into the ocean about 15 feet. While Corexit (basically a type of soap) itself is not toxic (an admittedly controversial claim), the resulting dispersed oil is quite toxic. Fish swimming through it can be and are harmed. Marine mammals like porpoises are seriously harmed when they rise to breathe through an oil slick.

But here is the good news. It turns out that there are about the equivalent of two Exxon Valdezes a year from natural oil seepage from the floor of the oceans. The Gulf has an ecosystem of bacteria that eat that oil, which are then eaten again by plankton. To those bacteria, dispersed oil is filet mignon. They thrive and grow rapidly, turning that toxic waste into nutrients, which are absorbed by the plankton. The bacteria keep on growing until they lose their source of nutrition (the toxic oil) and then die out over time. Note: once absorbed by the bacteria, the oil is no longer toxic. There are no toxic minerals like mercury introduced into the ecosystem.

update:

Jet, kipper, lucile, mimosa, nut, oysterette, prune, quasimodo, royal, sago, tango, xray, yesplease

Tila Tequila’s face turned bloody this past Friday at the Gathering of the Juggalos, and I was onstage behind her when it happened. (…) This was the first year the Gathering of the Juggalos, an annual Midwestern pilgrimage for Insane Clown Posse fans, had scheduled a Ladies’ Night. (…) It’s worth noting that Insane Clown Posse fans routinely throw things at these annual Gatherings–many times at each other; many times at the humans onstage.

There were several rubber dildos hurled at her–pretty sure the sex toys missed her, but it was hard to keep track at the time– along with beer cans, Faygo containers, Stryofoam cups, liquor bottles, cigarettes, mustard, half a lemon, a pizza slice, a pearl bracelet, a pudding cup, an unopened can of ICP’s self-branded energy drink Spazmatic, part of a watermelon allegedly soaked in feces and urine, a clothed baby doll, a mini Mag Lite, a bag of chicken tenderloin. When Tequila first came out, a sign reading CUNT was there to greet her.

{ Village Voice | Continue reading | Tila Tequila suffers cuts, but escapes juggalos attack | CNN }

I’d rather sink… than call Brad for help

The Instinctive Drowning Response is what people do to avoid actual or perceived suffocation in the water. And it does not look like most people expect. There is very little splashing, no waving, and no yelling or calls for help of any kind.

To get an idea of just how quiet and undramatic from the surface drowning can be, consider this: It is the number two cause of accidental death in children, age 15 and under (just behind vehicle accidents). (…) In ten percent of those drownings, the adult will actually watch them do it, having no idea it is happening. Drowning does not look like drowning.

1. Except in rare circumstances, drowning people are physiologically unable to call out for help. The respiratory system was designed for breathing. Speech is the secondary or overlaid function. Breathing must be fulfilled, before speech occurs.

photo { Playboy, July 1970 }

‘Life can only be understood backwards; but it must be lived forwards.’– Kierkegaard

Although the current spill still limited to the US coasts of the Gulf, this accident is already unprecedented in history because its injury to such a large variety of ecosystems of uniquely rich biodiversity that is impossible to cleanup. As the oil asphyxiates mangrove trees, perturbs microbial communities and disrupts the ecological stability affecting animals and microbes throughout the food chain– It may be hundreds of year before these ecosystems recover, making it the worst and possibly the most far reaching of any previous oil disaster in the history of this planet.

{ Journal of Cosmology | The Gulf Oil Gusher Catastrophe: Toxic Chemicals, Undersea Oil Plumes, Currents of Death. | Tracking and Predicting the Gulf Oil Spill Plumes | Can We Learn From the Past? | Thanks Douglas }

artwork { Everett Millais, Ophelia, 1851-1852 }

BBQ special event

{ A Lamborghini BLEW UP on Rodney Street, which serves as the off-ramp for the BQE’s Metropolitan Avenue exit. | New York Shitty | via Copyranter }

unrelated { unrelated: For the last two years of his life, after an attempted suicide, Schumann was confined to a mental institution at his own request. }

Eye out for other fellow always. Get rid of him quickly.

When the Conficker computer “worm” was unleashed on the world in November 2008, cyber-security experts didn’t know what to make of it. It infiltrated millions of computers around the globe. It constantly checks in with its unknown creators. It uses an encryption code so sophisticated that only a very few people could have deployed it. For the first time ever, the cyber-security elites of the world have joined forces in a high-tech game of cops and robbers, trying to find Conficker’s creators and defeat them. The cops are failing. And now the worm lies there, waiting…

{ The Atlantic | Continue reading | Thanks Daniel }

‘Battle not with monsters, lest you become a monster, and if you gaze into the abyss, the abyss also gazes into you.’ –Nietzsche

Above the Restoration Hardware in this Jersey Shore town, not far from the Navesink River, lurks a Wall Street giant.

Here, inside the humdrum offices of a tiny trading firm called Tradeworx, workers in their 20s and 30s in jeans and T-shirts quietly tend high-speed computers that typically buy and sell 80 million shares a day.

But on the afternoon of May 6, as the stock market began to plunge in the “flash crash,” someone here walked up to one of those computers and typed the command HF STOP: sell everything, and shutdown.

Across the country, several of Tradeworx’s counterparts did the same. In a blink, some of the most powerful players in the stock market today — high-frequency traders — went dark. The result sent chills through the financial world.

After the brief 1,000-point plunge in the stock market that day, the growing role of high-frequency traders in the nation’s financial markets is drawing new scrutiny.

By earth end the cloudy but I badly went e brandnew bankside, bedamp and I do, and a plumper at that!

{ Police have made a public appeal for help to solve the mystery of how a grandfather was apparently shot by a stray bullet as he tended his front garden. Detectives, who admit that it is one of the strangest cases they have encountered, are working on one theory that the gunman could have fired into the air, possibly streets away, and remains unaware of the consequences of his actions. | Times | Continue reading }

‘The ceremony of innocence is drowned; the best lack all conviction, while the worst are full of passionate intensity.’ –Yeats

{ A dog that has been seen at nearly every demonstration in Athens over the last two years has turned up again during the recent protests against new austerity measures. He always seems to side with the protesters, whatever the dispute. | AFP/The Guardian | more l Thanks Willie }

Your future, our clutter

During the last two decades, the American economy has suffered from a series of legal, fiscal and monetary policies that have favored speculation over production. The result has been the financialization of the economy, which has been characterized in economic terms by an unhealthy growth in debt at all levels of the economy and in cultural terms by the monetization of all values. Entities such as Fannie Mae and Freddie Mac were perfect examples of how the free market had been corrupted before the 2008 financial crisis. The crisis itself demonstrated, however, that the logic of the system required all large institutions to suffer from a similar flaw. Yet these flaws were not inevitable, even at the height of the crisis; they were deliberate political choices. While stakeholders of some institutions, such as Lehman Brothers, were wiped out, those of other firms were not and some were even made whole. The most egregious example of this was the handling of American International Group (AIG), the insurance giant that morphed itself into a giant hedge fund while enriching the officials responsible for some of the most ill-informed judgments in financial history. There was no reason for the government to handle the AIG failure in a manner that made whole foreign counterparties and Goldman Sachs; alternatives including offering a blanket credit guarantee to the insurance company that would have calmed markets and obviated the necessity of the company paying out one hundred cents on the dollar for its reckless insurance bets on synthetic mortgage obligations. While the result – avoidance of the extinction-level-event that an AIG failure would have been for the financial system – was the correct one, the means by which it was achieved furthered the agenda of socializing losses and privatizing gains and bred deep distrust in the government and the system.

Much of the crisis could have been avoided had policymakers and investors operated under realistic assumptions about how markets and economies work. Several years ago, former Federal Reserve Chairman Alan Greenspan described the failure of interest rates to react in the manner he expected as a “conundrum.” We now know that Mr. Greenspan was operating under a false set of assumptions about human nature, as well as a misguided understanding about how market participants behave. As noted in my book, had Mr. Greenspan been an acolyte of Hyman Minsky instead of Ayn Rand, he would have been less susceptible to such a fatal conceit. But beyond that, the real conundrum in modern markets is the continued reliance of investors and policymakers on two false mantras. The first is that markets are efficient; and the second is that investors are rational. Both assertions are so decidedly specious that one has to question both the sanity or the intelligence of those who cling to them.

{ Michael E. Lewitt | Continue reading }

A day after a harrowing plunge in the stock market, federal regulators were still unable on Friday to answer the one question on every investor’s mind: What caused that near panic on Wall Street? (…) The cause or causes of the market’s wild swing remained elusive, leaving what amounts to a $1 trillion question mark hanging over the world’s largest, and most celebrated, stock market. (…)

A government official who was involved in the investigation said regulators had moved away from a theory that it was a trading mistake — a so-called fat finger episode — and were examining the links between the futures and cash markets for stocks.

In particular, this official said, it appeared that as stock trading was slowed on the New York Exchange when big price moves started, orders moved automatically to other, electronic exchanges that did not have pricing restrictions.

The pressure in the less-liquid markets was amplified by the computer-driven trades, which led still other traders to pull back. Only when traders began to manually respond to the sharp drop did the market seem to turn around, said the official, who spoke on the condition of anonymity because the investigation was not complete.

On Friday evening, another government official directly involved in the investigation said that regulators had not yet been able to completely rule out any of the widely discussed possible causes of the market’s gyrations.

This official, who also spoke on the condition of anonymity, said that regulators had collected statistical and trading data from stock and futures exchanges, and had begun cross-analyzing that with trading reports from brokerage firms and large market participants. Regulators have also gathered anecdotal accounts of what happened from hedge funds and other trading firms. (…)

Over the last five years, the stock market has split into a plethora of new competing hubs and trading outlets, a legacy of deregulation earlier this decade and fast-paced technological change. On Friday, the rivalry between the two main exchanges erupted into view as each publicly pointed the finger at the other for being a main cause of the collapse on Thursday, which sent shockwaves around the globe. (…)

The absence of a unified system to halt trading in individual stocks led to bitter accusations between exchanges on Friday. Robert Greifeld, chief executive of Nasdaq OMX, appeared on CNBC to criticize the New York Stock Exchange for halting trading for up to 90 seconds in half a dozen stocks on Thursday.

“Stopping for 90 seconds in time of crisis is exactly equivalent to not picking up the phone,” Mr. Greifeld said.

A few minutes later, Duncan L. Niederauer, chief executive of NYSE Euronext, responded in an interview on CNBC, blaming Nasdaq’s computers for continuing trading while the market was in free fall.

{ NY Times | Continue reading | update: As several stocks declined sharply under heavy selling pressure, the New York Stock Exchange, one of the largest pools, stopped or slowed trading in particular stocks. | Washington Post | full story }

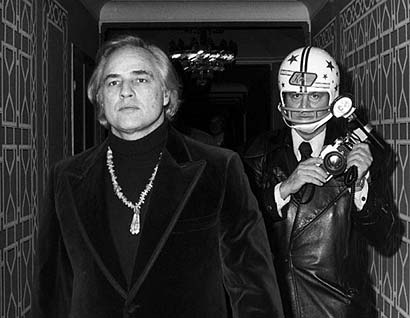

photo { Ron Gallela | SMASH HIS CAMERA, Opening with the artist at Clic Gallery, 424 Broome Street, NYC, June 10th | Read more }

‘Some cause happiness wherever they go; others, whenever they go.’ –Oscar Wilde

Wildlife experts are hunting a rogue bull elephant in southern India accused of killing at least 10 female elephants during a testosterone-induced ’sex rampage’.

‘I don’t hate people. I just feel better when they are not around.’ –Bukowski

Usually when you see people who have been stung by box jellyfish with that number of the tentacle contacts on their body, it’s usually in a morgue. (…) The creature didn’t just sting the 10-year-old girl. It enveloped her: Its tentacles wrapped around her limbs and wouldn’t let go. She couldn’t see or breathe. The creature, which is capable of killing an adult in four minutes, wrapped its tentacles tighter and knocked her unconscious. (…) After several weeks in the hospital Shardlow is still feeling the effects - but the fact she is feeling anything at all - let alone doing as well as she is baffles Seymour. For now, besides scarring and memory loss, she is doing well.

related { Nomura jellyfish }

‘I always try to believe the best of everybody–it saves so much trouble.’ –Rudyard Kipling

The Oswego man charged with fatally shooting his wife and their three school-age children told police he was having marital problems caused by his affair in Mexico seven months earlier and his wife’s lack of interest in adopting his Druid beliefs.

{ Chicago Breaking News | Continue reading }

A controversial alternative health guru is suing after a taste of his own medicine nearly killed him.

Gary Null - described on quackwatch.org as “one of the nation’s leading promoters of dubious treatment for serious disease” - claims the manufacturer of Gary Null’s Ultimate Power Meal overloaded the supplements with Vitamin D.

The buff “Joy of Juicing” author, whose products include Red Stuff Powder and Gary Null’s Heavenly Hair Cleaner, claims he suffered kidney damage and was left bloodied and in intense pain from two daily servings of the supplement.

{ NY Daily News | Continue reading }

A Newport Beach man attempting to steal a pornographic magazine shoved a liquor store owner so fiercely that the man flew through the air and landed on the back of his head.

The owner died the day after the vicious attack on July 28, 2007 from a fractured skull and massive bleeding in the brain.

related { Man killed in bizarre high speed crash. }

‘If human beings were shown what they’re really like, they’d either kill one another as vermin, or hang themselves.’ –Aldous Huxley

Did you hear about the Bangladeshi brick company that beheaded an employee to improve the color of its bricks?

This tragic incident raises many questions. The article is vague, but I assume a supervisor or some sort of boss was leading this strategy. So I wonder how the employee was chosen? Was he the worst worker, the biggest complainer, or the guy who looked the most like a brick? (…)

I wonder how the boss broke the news to the employee. Did he work up to it with a list of criticisms about the employee’s job performance? As a boss, you don’t want to start that sort of conversation with the beheading part. Begin with something like “I noticed you’ve been late twice this week.” That way it isn’t such a cruel shock when you get to the decapitation scenario.

Get another cup of java

{ Jennifer Reed Bike Crash Portrait | Crash portraits | more }