When the rich loses weight, the poor dies

There is no particular reason why – contrary to some forecasts – this deal [Heinz–Buffet] signals a turn in the economy that should spark a wave of mergers and acquisitions. That said, Mr Buffett has reminded us that, when money is cheap, takeovers follow. In that sense, leveraged deals could be seen as central bankers’ gift to acquirers. […]

Berkshire never bit on Heinz until now, when a deal arrived with terms that guarantee it a 6 per cent return.

In a world of near-zero interest rates, that 6 per cent looks pretty attractive. Mr Buffett, evidently, does not expect rates to rise sharply any time soon. A decade ago, he demanded a first-day return of 13 per cent before he would bother to consider a deal. Now the Oracle takes 6 per cent for his money. We should pay attention. There could hardly be a stronger signal that the investing tide has changed.

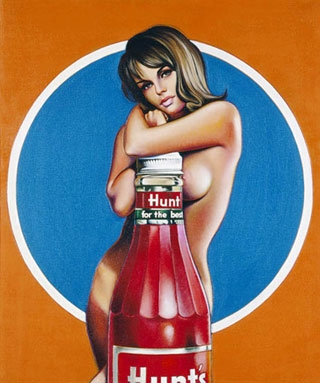

art { Mel Ramos }