Don’t look back, you ain’t staying

By 1790, the new republic was in arrears on $11,710,000 in foreign debt. These were obligations payable in gold and silver. Alexander Hamilton, the first secretary of the Treasury, duly paid them. In doing so, he cured a default.

Hamilton’s dollar was defined as a little less than 1/20 of an ounce of gold. So were those of his successors, all the way up to the administration of Franklin D. Roosevelt. But in the whirlwind of the “first hundred days” of the New Deal, the dollar came in for redefinition. The country needed a cheaper and more abundant currency, FDR said. By and by, the dollar’s value was reduced to 1/35 of an ounce of gold.

By any fair definition, this was another default. Creditors both domestic and foreign had lent dollars weighing just what the Founders had said they should weigh. They expected to be repaid in identical money. […]

The lighter Roosevelt dollar did service until 1971, when President Richard M. Nixon lightened it again. In fact, Nixon allowed it to float. No longer was the value of the greenback defined in law as a particular weight of gold or silver. It became what it looked like: a piece of paper.

Yet the U.S. government continued to find trusting creditors. Since the Nixon default, the public’s holdings of the federal debt have climbed from $303 billion to $11.9 trillion.

If today’s political impasse leads to another default, it will be a kind of technicality. Sooner or later, the Obama Treasury will resume writing checks. The question is what those checks will buy.

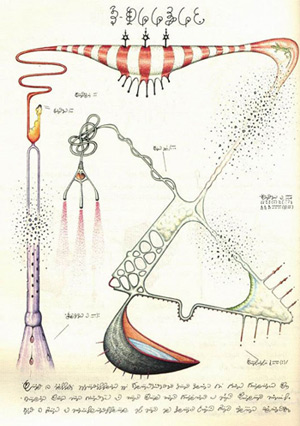

art { Luigi Serafini }