‘History is the science of what never happens twice.’ —Paul Valéry

A recent Wall Street Journal/NBC News poll found that 49% of Americans still believe the U.S. economy is in recession, even though we are now in the sixth year of the recovery. […] If investing when others are skeptical has historically been a successful strategy, why don’t more investors do so? […] Taking advantage of the findings discussed earlier requires investing when the economy and market seem to be at their worst, and rebalancing when conditions appear to be the best. This is counterintuitive for many investors, who tend to wait for confirming evidence before acting. This is related to herd behavior, the tendency to follow the crowd with portfolio decisions. Investing when others are skeptical is emotionally difficult but, as we’ve shown, tends to be when rewards are the greatest.

related { It is not possible for a human to know whether Bank of America made money or lost money last quarter. }

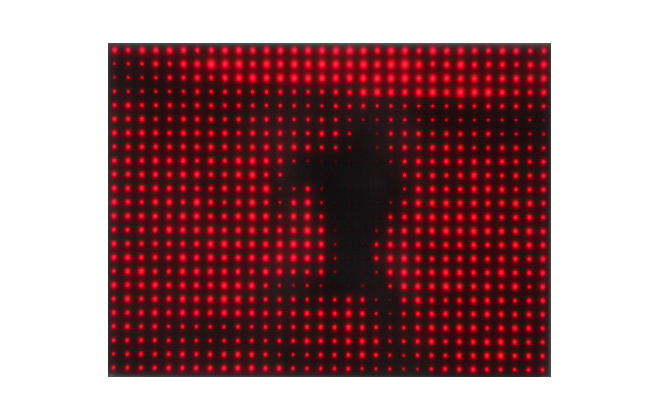

art { Jim Campbell, Ambiguous Icon #1 Running Falling, 2000 }