Your future, our clutter

During the last two decades, the American economy has suffered from a series of legal, fiscal and monetary policies that have favored speculation over production. The result has been the financialization of the economy, which has been characterized in economic terms by an unhealthy growth in debt at all levels of the economy and in cultural terms by the monetization of all values. Entities such as Fannie Mae and Freddie Mac were perfect examples of how the free market had been corrupted before the 2008 financial crisis. The crisis itself demonstrated, however, that the logic of the system required all large institutions to suffer from a similar flaw. Yet these flaws were not inevitable, even at the height of the crisis; they were deliberate political choices. While stakeholders of some institutions, such as Lehman Brothers, were wiped out, those of other firms were not and some were even made whole. The most egregious example of this was the handling of American International Group (AIG), the insurance giant that morphed itself into a giant hedge fund while enriching the officials responsible for some of the most ill-informed judgments in financial history. There was no reason for the government to handle the AIG failure in a manner that made whole foreign counterparties and Goldman Sachs; alternatives including offering a blanket credit guarantee to the insurance company that would have calmed markets and obviated the necessity of the company paying out one hundred cents on the dollar for its reckless insurance bets on synthetic mortgage obligations. While the result – avoidance of the extinction-level-event that an AIG failure would have been for the financial system – was the correct one, the means by which it was achieved furthered the agenda of socializing losses and privatizing gains and bred deep distrust in the government and the system.

Much of the crisis could have been avoided had policymakers and investors operated under realistic assumptions about how markets and economies work. Several years ago, former Federal Reserve Chairman Alan Greenspan described the failure of interest rates to react in the manner he expected as a “conundrum.” We now know that Mr. Greenspan was operating under a false set of assumptions about human nature, as well as a misguided understanding about how market participants behave. As noted in my book, had Mr. Greenspan been an acolyte of Hyman Minsky instead of Ayn Rand, he would have been less susceptible to such a fatal conceit. But beyond that, the real conundrum in modern markets is the continued reliance of investors and policymakers on two false mantras. The first is that markets are efficient; and the second is that investors are rational. Both assertions are so decidedly specious that one has to question both the sanity or the intelligence of those who cling to them.

{ Michael E. Lewitt | Continue reading }

A day after a harrowing plunge in the stock market, federal regulators were still unable on Friday to answer the one question on every investor’s mind: What caused that near panic on Wall Street? (…) The cause or causes of the market’s wild swing remained elusive, leaving what amounts to a $1 trillion question mark hanging over the world’s largest, and most celebrated, stock market. (…)

A government official who was involved in the investigation said regulators had moved away from a theory that it was a trading mistake — a so-called fat finger episode — and were examining the links between the futures and cash markets for stocks.

In particular, this official said, it appeared that as stock trading was slowed on the New York Exchange when big price moves started, orders moved automatically to other, electronic exchanges that did not have pricing restrictions.

The pressure in the less-liquid markets was amplified by the computer-driven trades, which led still other traders to pull back. Only when traders began to manually respond to the sharp drop did the market seem to turn around, said the official, who spoke on the condition of anonymity because the investigation was not complete.

On Friday evening, another government official directly involved in the investigation said that regulators had not yet been able to completely rule out any of the widely discussed possible causes of the market’s gyrations.

This official, who also spoke on the condition of anonymity, said that regulators had collected statistical and trading data from stock and futures exchanges, and had begun cross-analyzing that with trading reports from brokerage firms and large market participants. Regulators have also gathered anecdotal accounts of what happened from hedge funds and other trading firms. (…)

Over the last five years, the stock market has split into a plethora of new competing hubs and trading outlets, a legacy of deregulation earlier this decade and fast-paced technological change. On Friday, the rivalry between the two main exchanges erupted into view as each publicly pointed the finger at the other for being a main cause of the collapse on Thursday, which sent shockwaves around the globe. (…)

The absence of a unified system to halt trading in individual stocks led to bitter accusations between exchanges on Friday. Robert Greifeld, chief executive of Nasdaq OMX, appeared on CNBC to criticize the New York Stock Exchange for halting trading for up to 90 seconds in half a dozen stocks on Thursday.

“Stopping for 90 seconds in time of crisis is exactly equivalent to not picking up the phone,” Mr. Greifeld said.

A few minutes later, Duncan L. Niederauer, chief executive of NYSE Euronext, responded in an interview on CNBC, blaming Nasdaq’s computers for continuing trading while the market was in free fall.

{ NY Times | Continue reading | update: As several stocks declined sharply under heavy selling pressure, the New York Stock Exchange, one of the largest pools, stopped or slowed trading in particular stocks. | Washington Post | full story }

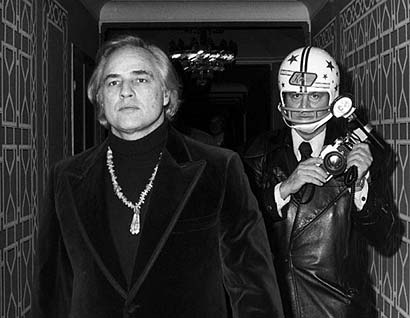

photo { Ron Gallela | SMASH HIS CAMERA, Opening with the artist at Clic Gallery, 424 Broome Street, NYC, June 10th | Read more }