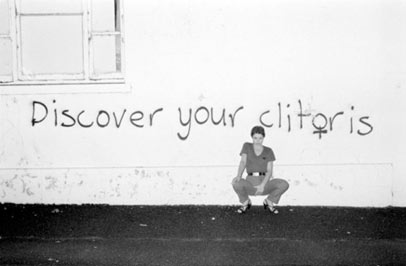

She’s on it

We don’t quite understand small probabilities.

You often see in the papers things saying events we just saw should happen every ten thousand years, hundred thousand years, ten billion years. Some faculty here in this university had an event and said that a 10-sigma event should happen every, I don’t know how many billion years.

So the fundamental problem of small probabilities is that rare events don’t show in samples, because they are rare. So when someone makes a statement that this in the financial markets should happen every ten thousand years, visibly they are not making a statement based on empirical evidence, or computation of the odds, but based on what? On some model, some theory.

So, the lower the probability, the more theory you need to be able to compute it. Typically it’s something called extrapolation, based on regular events and you extend something to what you call the tails. (…)

The smaller the probability, the less you observe it in a sample, therefore your error rate in computing it is going to be very high. Actually, your relative error rate can be infinite, because you’re computing a very, very small probability, so your error rate is monstrous and probably very, very small. (…)

There are two kinds of decisions you make in life, decisions that depend on small probabilities, and decisions that do not depend on small probabilities. For example, if I’m doing an experiment that is true-false, I don’t really care about that pi-lambda effect, in other words, if it’s very false or false, it doesn’t make a difference. (…) But if I’m studying epidemics, then the random variable how many people are affected becomes open-ended with consequences so therefore it depends on fat tails. So I have two kinds of decisions. One simple, true-false, and one more complicated, like the ones we have in economics, financial decision-making, a lot of things, I call them M1, M1+.