‘I have the simplest tastes. I am always satisfied with the best.’ –Oscar Wilde

The speculation of what Apple is going to do with all their cash has long been a favorite topic in the tech and financial press. (…) What’s the point of having all that money if you’re not going to spend it?

That thinking is what we saw when Apple recently announced their cash plans. (..) “Saddened by Apple’s plan for a huge dividend. Apparently, they have nothing truly capital-intensive in the product pipeline.” (…)

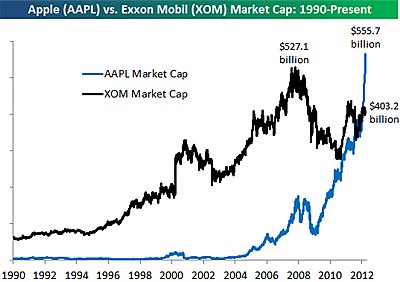

Even after issuing dividends and repurchasing shares, Apple’s cash reserves will likely grow this year. They added more than $35 billion in cash and equivalents last year alone. There’s nothing “capital-intensive” that they can’t do, short of opening an Apple Store on the moon. (…)

The idea floating around before Apple’s Monday announcement that they would be buying a company like Foxconn or building factories of their own seems to make sense, since Apple is one of the more vertically integrated consumer electronics companies in the world. And they are, after all, notorious for both control and quality. But they’ve managed to lead the industry on the latter without owning a significant portion of their supply chain. (…)

Apple has this enormous negotiating power, and they use it, I am told by our sources, very aggressively to come in and basically say, “Show us your entire cost structure, every single part of what you pay and what you… and we are going to give you a razor-thin profit margin that you’re allowed to keep.

In other words: Why buy the cow?

Apple also, more importantly, finances the factories by loaning them cash and buying significant amounts of components in advance. This “Bank of Apple” strategy further establishes control over the factories, locks out competition and seems to be why competitors can’t seem to match Apple’s cost structure for products like the iPad. (…)

This brings us to those who think Apple has run out of ideas on what to do with their cash. The fevered result of this are the acquisition talks — hence the recently oft-mentioned and largely nonsensical suggestion that Apple should buy a company like Twitter. But Apple’s approach to acquisitions has always been extremely conservative, especially compared to their brethren. Since 2010 Apple’s bought a grand total of nine companies. In that same period Google has bought 52.

{ TechCrunch | Continue reading | Thanks Glenn }