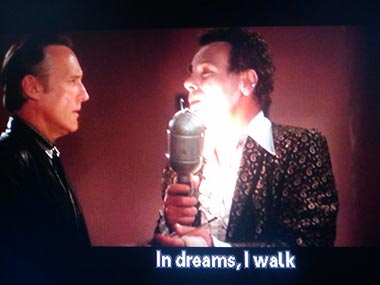

Voodoo smile, Siamese twins

While I am not a fan of most big firm fundamental analysts, over the years, Merrill Lynch has had some sharp guys in their Chief Strategist/Economist positions. (…)

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras – excesses are never permanent.

4. Exponential rising and falling markets usually go further than you think.

5. The public buys the most at the top and the least at the bottom.

{ Lessons from Merrill Lynch | via Barry Ritholtz | Continue reading }